Best Health Insurance in Wisconsin 2024

In Wisconsin, finding the best health insurance plan involves considering various factors such as coverage options, network availability, and affordability. Several insurance companies offer a range of plans tailored to meet the diverse needs of individuals and families across the state.

When choosing a health insurance plan in Wisconsin, individuals should prioritize comprehensive coverage for essential health services, including doctor visits, hospital stays, prescription drugs, and preventive care. Plans with low deductibles and copayments can help individuals manage healthcare costs effectively.

This comprehensive guide to help you find the perfect plan to meet your healthcare needs and budget.

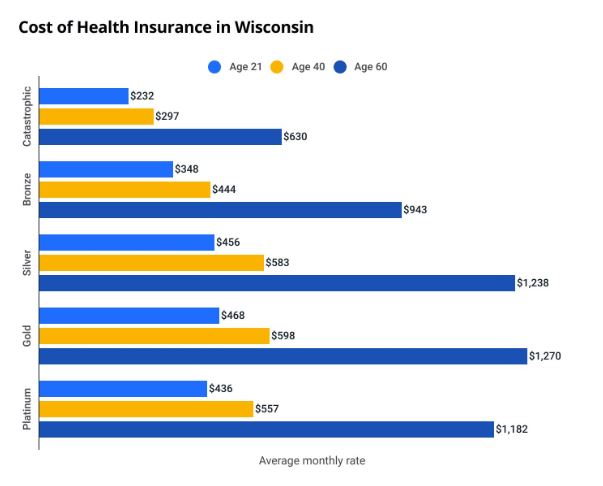

How much does health insurance cost in Wisconsin?

The typical price for a Silver health insurance plan in Wisconsin stands at $583 per month for a 40-year-old. Your monthly expense is affected by various factors such as the plan tier you select and your age. Generally, higher-tier plans come with higher rates in comparison to lower-tier plans.

It’s crucial to bear in mind that with a higher-tier plan, you’ll incur lower costs when visiting the doctor or filling a prescription, unlike lower-tier plans.

Age significantly impacts health insurance expenses. In Wisconsin, the average health insurance costs rise by 28% from ages 21 to 40.

Health insurance costs escalate further as you reach middle age. On average, a 60-year-old in Wisconsin will pay over twice as much as a 40-year-old for identical coverage.

Best Overall for Health Insurance in Wisconsin

In general, HealthPartners stands out as the top choice for health insurance in Wisconsin. This provider excels in affordability, claims processing, and plan adaptability. It boasts one of the most competitive premiums among the insurers compared, coupled with the highest rate of claims acceptance.

HealthPartners

HealthPartners offers the best health insurance in Wisconsin and offers 10 Silver PPO plans While PPO plans may come with higher costs, they boast expansive provider networks and eliminate the need for specialist referrals. This makes them an ideal choice for those prioritizing freedom of choice and convenience, even at a slightly costlier.

- HealthPartners boasts a broad network of providers across Wisconsin giving you more flexibility in choosing your doctors and hospitals.

- Offer various wellness programs and incentives.

- High customer satisfaction

- They offer a variety of Medicare Advantage plans with additional benefits.

- Premiums can be on the higher end.

- Deductibles and out-of-pocket costs can vary depending on the chosen plan.

Plan Recommendations

- Robin Select $3,500 HSA Silver: $464 per month

- Robin Oak $3,500 HSA Silver: $521 per month

- Atlas $3,500 HSA Silver: $528 per month

Best Health Insurance in Wisconsin for Low Out-of-Pocket Costs

MercyCare Health Plans is Wisconsin’s leading health insurance provider for minimizing out-of-pocket expenses. Notably, MercyCare Health Plans stands out for its affordability, offering the most competitive premiums for Gold and Platinum plans in the state.

Additionally, the company maintains reasonable ratings for its claims denial rate and average maximum out-of-pocket costs (MOOP). With these attributes, MercyCare Health Plans proves to be a reliable choice for individuals seeking comprehensive coverage with minimal financial burden.

MercyCare Health Plans

MercyCare Health Plans offers two affordable Gold plans in Wisconsin, with an average monthly cost of $416 and an average maximum out-of-pocket (MOOP) expense of $5,850. Additionally, MercyCare Health Plans boasts a favorable claims denial rate of 10.04%, indicating high approval rates compared to competitors.

This provider’s Gold-tier plans are HMOs, offering lower monthly premiums but requiring you to use in-network providers for coverage and to get specialist referrals.

- Competitive Bronze and Silver metal tiers- the best option for budget-conscious individuals.

- Offer various wellness programs and incentives.

- High customer satisfaction

- Limited Platinum plan.

- Limited Medicare Advantage options.

Recommendations Plan:

- MercyCare HMO Gold HDHP: $429 per month

- MercyCare HMO Gold Standard: $404 per month

Best Cheap Health Insurance in Wisconsin

MercyCare could be a great choice for individuals prioritizing affordability and in-network care within Wisconsin. In Wisconsin, MercyCare Health Plans offers three Silver HMO plans.

HMOs typically cost less than other plans but have limited provider choices. Opt for this plan if you’re okay with using network providers and need referrals for specialists.

MercyCare Health Plans

MercyCare Health Plans offers two affordable Gold plans in Wisconsin, with an average monthly cost of $416 and an average maximum out-of-pocket (MOOP) expense of $5,850. Additionally, MercyCare Health Plans boasts a favorable claims denial rate of 10.04%, indicating high approval rates compared to competitors.

This provider’s Gold-tier plans are HMOs, offering lower monthly premiums but requiring you to use in-network providers for coverage and to get specialist referrals.

- Lowest premiums.

- Fair average MOOP.

- High customer satisfaction.

- Reliable claims management reputation.

- Has limited plan types.

- Limited Medicare Advantage options.

Recommendations Plan:

- MercyCare HMO Silver Standard: $441 per month

- MercyCare HMO Silver HDHP: $450 per month

- MercyCare HMO Silver Option A: $451 per month

Best Health Insurance for low-income in Wisconsin

MercyCare Health Plans is Wisconsin’s top choice for low-income individuals. We focused on affordable monthly premiums and included only companies offering Silver plans with cost-sharing reductions (CSRs). Across 33 EPOs, 82 HMOs, one POS, and 10 PPO plans, we evaluated options.

CSRs can cut deductibles and out-of-pocket maximums for households earning under 250% of the federal poverty level (FPL). While a standard Silver plan covers about 70% of eligible costs, CSR plans offer higher cost-sharing based on annual income.

MercyCare Health Plans

Low-income Wisconsin residents might prefer MercyCare Health Plans. Their health plans for those earning 201%–250% of the federal poverty level cost about $447 monthly, with a $6,217 maximum out-of-pocket. Plus, they approve more claims than many competitors in the state.

MercyCare Health Plans offers three Silver HMO plans with cost-sharing reductions (CSRs). These plans are ideal for low-income individuals seeking affordable monthly premiums and are okay with using in-network providers for covered healthcare services.

- Lowest premiums.

- Fair average MOOP.

- Reliable claims management reputation.

- Has limited plan types.

Recommendations Plan:

- 201%–250% of the FPL: $441 per month

- 151%–200% of the FPL: $441 per month

- Up to 150% of the FPL: $441 per month

Best Health Insurance for Young Adults in Wisconsin

HealthPartners stands as the top health insurance provider for young adults in Wisconsin.

Offering Bronze or Catastrophic plans, they feature lower premiums but higher maximum out-of-pocket (MOOP) costs. Catastrophic plans, especially, are exclusive to individuals under 30 years old.

In Wisconsin, our analysis covered the following plan tiers and types:

- Catastrophic: Eight EPO plans, nine HMO plans, and three PPO plans

- Bronze: 13 EPO plans, 20 HMO plans, and one POS plan

- Expanded Bronze: 36 EPO plans, 76 HMO plans, three POS plans, and nine PPO plans

HealthPartners

HealthPartners offers the top health insurance options for young adults in Wisconsin. With 12 Catastrophic, Bronze, and Expanded Bronze plans available, the average monthly cost is $295, with a maximum out-of-pocket (MOOP) limit of $8,675. HealthPartners boasts a claims denial rate of 6.57%, the best in Wisconsin.

Metal tiers show how much coverage a plan provides. Catastrophic, Bronze, and Expanded Bronze plans are good for young adults who want lower monthly payments and don’t expect to use many medical services.

- A comprehensive network of providers across Wisconsin gives you more flexibility in choosing your doctors and hospitals.

- Offer various wellness programs and incentives.

- Offer a variety of plans to cater to different needs and budgets.

- Affordable monthly premiums.

- High MOOP costs.

- Premiums can be on the higher end.

Plan Recommendations

- Robin Select $7,500 HSA Bronze:

- $254/month for 18 year olds

- $285/month for 26 year olds

- Robin Oak $7,500 HSA Bronze:

- $285/month for 18 year olds

- $320/month for 26 year olds

- Atlas $7,500 HSA Bronze:

- $289/month for 18 year olds

- $324/month for 26 year olds

Cheapest health insurance in Wisconsin

The most affordable Silver health insurance option in Wisconsin is the Anthem Silver Pathway plan. It’s accessible to about 40% of Wisconsin’s residents, including those residing in the Milwaukee metro area.

Cheapest health insurance in WI

| Tier | Cheapest plan | Monthly cost |

|---|---|---|

| Catastrophic | Dean Focus Network Catastrophic Safety Net | $215 |

| Bronze | Dean Focus Network Bronze Standard | $268 |

| Silver | Anthem Silver Pathway/Lean 5900/40% Standard | $402 |

| Gold | Dean Focus Network Gold | $424 |

| Platinum | Group Health Cooperative-SCW Select Platinum | $531 |

Cheapest health insurance plan by Wisconsin county

The cheapest health insurance plan varies by location. Wisconsin offers 15 different cheapest Silver health insurance plans across its 72 counties.

Cheapest health insurance by WI county

| County | Cheapest Silver plan | Monthly rate |

|---|---|---|

| Adams | Dean Health Plan Dean Silver | $498 |

| Ashland | Security Health Plan Select | $606 |

| Barron | Security Health Plan Select | $583 |

| Bayfield | Medica Essentia Choice Care | $514 |

| Brown | Common Ground CGHC Silver | $460 |

| Buffalo | Medica Silver Standard | $588 |

| Burnett | HealthPartners Atlas $3,800 HSA Silver | $586 |

| Calumet | Anthem Silver Pathway | $433 |

| Chippewa | Security Health Plan Select | $586 |

| Clark | Security Health Plan SimplyOne | $540 |

| Columbia | Anthem Silver Blue Preferred | $464 |

| Crawford | Dean Health Plan Dean Silver | $516 |

| Dane | Dean Focus Network Silver | $427 |

| Dodge | Common Ground CGHC Silver | $439 |

| Door | Common Ground CGHC Silver | $460 |

| Douglas | Medica Essentia Choice Care | $514 |

| Dunn | Security Health Plan Select | $586 |

| Eau Claire | Security Health Plan Select | $586 |

| Florence | HealthPartners Robin Select Silver | $481 |

| Fond du Lac | Common Ground CGHC Silver | $439 |

| Forest | Security Health Plan SimplyOne | $503 |

| Grant | Dean Health Plan Dean Silver | $516 |

| Green | Anthem Silver Blue Preferred | $464 |

| Green Lake | HealthPartners Robin Select Silver | $481 |

| Iowa | Dean Silver | $514 |

| Iron | Security Health Plan Select | $543 |

| Jackson | Medica Silver Standard | $588 |

| Jefferson | Anthem Silver Blue Preferred | $464 |

| Juneau | Dean Health Plan Dean Silver | $498 |

| Kenosha | Anthem Silver Pathway | $446 |

| Kewaunee | Common Ground CGHC Silver | $460 |

| La Crosse | Medica Silver Standard | $588 |

| Lafayette | Dean Health Plan Dean Silver | $516 |

| Langlade | Security Health Plan SimplyOne | $503 |

| Lincoln | Security Health Plan SimplyOne | $498 |

| Manitowoc | Common Ground CGHC Silver | $460 |

| Marathon | Security Health Plan SimplyOne | $498 |

| Marinette | Common Ground CGHC Silver | $460 |

| Marquette | HealthPartners Robin Select Silver | $481 |

| Menominee | HealthPartners Robin Select Silver | $481 |

| Milwaukee | Anthem Silver Pathway | $402 |

| Monroe | Medica Silver Standard | $588 |

| Oconto | Common Ground CGHC Silver | $460 |

| Oneida | Security Health Plan SimplyOne | $503 |

| Outagamie | Anthem Silver Pathway | $433 |

| Ozaukee | Anthem Silver Pathway | $451 |

| Pepin | Security Health Plan Select | $586 |

| Pierce | Medica Silver Standard | $517 |

| Polk | Medica Medica Individual Choice Silver Standard | $523 |

| Portage | Security Health Plan SimplyOne | $498 |

| Price | Security Health Plan SimplyOne | $540 |

| Racine | Anthem Silver Pathway | $446 |

| Richland | Dean Health Plan Dean Silver | $498 |

| Rock | Anthem Silver Blue Priority | $446 |

| Rusk | Security Health Plan Select | $583 |

| Sauk | Dean Focus Network Silver | $458 |

| Sawyer | Security Health Plan Select | $606 |

| Shawano | Common Ground CGHC Silver | $460 |

| Sheboygan | Common Ground CGHC Silver | $439 |

| St. Croix | Medica Silver Standard | $517 |

| Taylor | Security Health Plan SimplyOne | $540 |

| Trempealeau | Medica Silver Standard | $588 |

| Vernon | Dean Health Plan Dean Silver | $516 |

| Vilas | Security Health Plan SimplyOne | $503 |

| Walworth | MercyCare HMO Silver | $453 |

| Washburn | Medica Essentia Choice Care | $514 |

| Washington | Anthem Silver Pathway | $451 |

| Waukesha | Anthem Silver Pathway | $451 |

| Waupaca | Common Ground CGHC Silver | $439 |

| Waushara | Common Ground CGHC Silver | $439 |

| Winnebago | Anthem Silver Pathway | $433 |

| Wood | Security Health Plan SimplyOne | $498 |

FAQs About Health Insurance in Wisconsin

Is there a penalty for not having health insurance in Wisconsin?

The fee for not having health insurance ended in 2018.

How many hours do you have to work to get health insurance in Wisconsin?

In Wisconsin, a small employer has 2 to 50 employees, and an eligible employee works at least 30 hours per week on a permanent basis according to state law.

Does Wisconsin have Obamacare?

Wisconsin residents use HealthCare.gov, the federally run health enrollment platform, to purchase ACA Marketplace plans.

What is Wisconsin state insurance called?

BadgerCare Plus

Does Wisconsin have mandatory insurance?

No, only Wisconsin drivers are required to have motor vehicle liability insurance.