Best Health Insurance in California

No matter who you are, medical insurance will inevitably become essential at some stage. Whether for routine check-ups or unexpected medical procedures, every individual requires coverage through an insurance policy.

This is where the confusion begins. With numerous plans and companies available, it’s easy to become overwhelmed, particularly if you’re new to shopping for a medical insurance plan.

So, learn more about California’s top health insurance companies to positively impact your life and your family’s well-being. Discover these insights in our upcoming article on MyMercys.

Countless companies offer excellent medical insurance in California, but selecting one should align with your specific needs.

The medical insurance cost is influenced by various factors, including the individual’s age and several others. These additional factors encompass health status and medical history, existing coverage and benefits, the type of plan selected (individual or family), and the state of residence.

Choosing the proper medical insurance company in California is crucial. This guide will help you find California’s best-rated and most budget-friendly health insurance plans. Let’s explore…

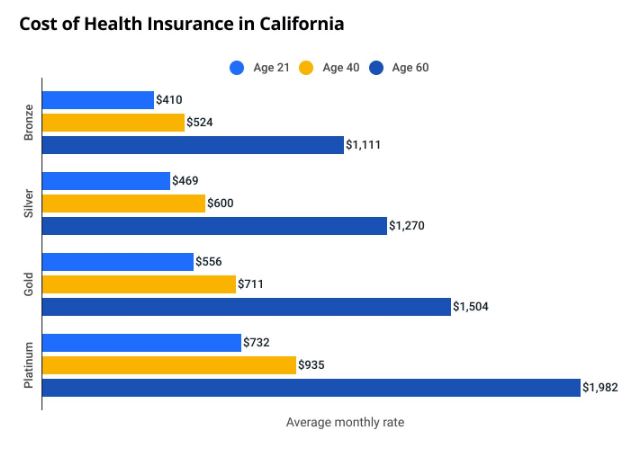

How much does health insurance cost in California?

A 40-year-old on a Silver plan, which offers balanced coverage and price, will pay about $600 monthly for health insurance in CA. Bronze plans generally have lower costs, but they provide less coverage. You’ll pay more monthly for plans with higher levels of coverage like Gold and Platinum; however, you’ll pay less when you require medical treatment.

A 60-year-old resident of California will pay more than twice the amount in the Silver plan average compared to a 40-year-old. However, depending on your age, your cost will be slightly higher than the typical cost. In the area you reside in California, The plan type you select and your particular requirements for coverage all affect how you will spend on Affordable Care Act (ACA) insurance.

Overall Best Health Insurance in California

Kaiser Permanente is considered the best health insurance provider in California overall. They offer strong plan options, keep out-of-pocket costs low, and manage claims well.

We examined 16 Silver health insurance plans in California, including EPO, PPO, and HMO plans, to find the best one.

Kaiser Permanente

Our top pick for California’s most affordable health insurance includes Kaiser Permanente, which offers one Silver HMO plan. Kaiser Permanente’s Silver HMO plan provides an organized network that lets you select a primary care physician and manage your health treatment in the group.

Kaiser Permanente offers an average cost of $512 for its plans, and the maximum out-of-pocket cost of plans of this type is $9,100. They have a denial rate of 8%, less than most competitors.

- Excellent lower out-of-pocket costs

- Approves almost all claims

- Average types of plans available

We recommend the below Silver plans –

- Silver 70 HMO: $512/month

Best Health Insurance in California for Low Out-of-Pocket Costs

Molina Healthcare provides the best health insurance in California for keeping out-of-pocket costs low. They offer affordable premiums and different coverage options.

To find the top plans in this category, we examined one Gold EPO plan, one Platinum EPO plan, three Gold PPO plans, and four Platinum PPO plans in California.

Molina Healthcare

Molina Healthcare is our top choice for the best health insurance in California for keeping out-of-pocket costs low. They offer one Gold HMO plan and one Platinum HMO plan, known for having lower maximum out-of-pocket expenses. HMO plans typically require you to see doctors within a specific network, but they usually have lower costs than other plans.

Molina Healthcare charges an average premium of $481, and the average maximum out-of-pocket cost for these plans is $6,600. While the company’s denial rate is lower than most competitors, it’s still relatively high, at about 19%.

- Affordable premiums

- Lower out-of-pocket costs

- Variety of plan available

- Often denies claims

We recommend the below Silver plans –

- Platinum 90 HMO: $509/month

- Gold 80 HMO: $453/month

Best Cheap Health Insurance in California

Molina Healthcare is the top choice for affordable health insurance in California. They offer cheaper plan choices, lower out-of-pocket costs, and reject fewer claims compared to most other providers.

To find the most affordable health care options, we reviewed 16 Silver plans in California. These included one Silver EPO plan, 2 Silver PPO plans, and 13 Silver HMO plans. We gave more weight to plans with lower monthly premiums, but keep in mind that lower premiums usually mean you’ll have to pay more out-of-pocket when you use medical services.

Molina Healthcare

Our top choice for affordable health insurance in California is Molina Healthcare. They provide one Silver plan, which is an HMO plan. It’s a good option for people looking for budget-friendly health coverage. With HMO plans, you usually need to use doctors and services within the network to get coverage.

It charges around $412 per month on average, with a maximum out-of-pocket cost of $9,100. Molina Healthcare rejects about 18.6% of claims, which is less than many other insurance companies.

- Affordable premiums

- Lower out-of-pocket costs

- Variety of plan available

- Often denies claims

We recommend the below cheap Silver plan –

- Silver 70 HMO: $412/month

Best Health Insurance for Young Adults in California

Kaiser Permanente provides the top health insurance for young adults in California. Their plans are affordable, with low out-of-pocket costs, and they hardly ever reject claims.

In our evaluation, we considered 18 Bronze HMO plans, 6 Bronze PPO plans, 1 Catastrophic EPO plan, and 14 Catastrophic HMO plans. It’s important to note that only people under 30 can select Catastrophic plans.

Kaiser Permanente

Our top choice for young adults in California is Kaiser Permanente. Young adults usually go for plans with less coverage because they typically need fewer medical services.

Kaiser Permanente offers two Bronze plans and one Catastrophic plan. These plans cost around $271 monthly, with a maximum out-of-pocket expense of about $8,533 annually. Kaiser Permanente doesn’t offer PPO or POS plans, but its EPO plans often have lower costs when you use its network of doctors.

The company denies about 8% of claims, which is lower than many other insurers.

- Minimal claim denials

- Lower out-of-pocket maximum costs

We recommend the below plans for young adults –

- Bronze 60 HDHP HMO

- $512/month for 18 year olds

- $326/month for 26 year olds

- Minimum Coverage HMO

- $220/month for 18 year olds

- $253/month for 26 year olds

- Bronze 60 HMO

- $304/month for 18 year olds

- $336/month for 26 year olds

Best Health Insurance by Plan Type in California

Health insurance companies provide various types of plans. In California, you can choose from two Silver PPO plans, one Silver EPO plan, and 13 Silver HMO plans. The top providers for all these plan types are:

- PPO: Health Net

- EPO: Anthem Blue Cross

- HMO: Kaiser Permanente

Our analysis focused solely on Silver plans, which strike a balance between monthly payments and what you pay when you receive medical services. These plans benefit individuals who frequently visit the doctor or require medical care.

PPO: Health Net

Our top choice for the best health insurance in California with Silver PPO plans is Health Net. They charge around $560 monthly, with a maximum out-of-pocket cost of $9,100. The provider’s denial rate is not mentioned.

PPO plans allow you to select your doctors without requiring a referral to see specialists. While they’re popular, they can be more expensive than HMO plans. These plans are great if you prefer choosing your doctors and don’t mind paying extra.

We recommend the below Silver PPO plans from Health Net –

- Silver 70 Ambetter PPO: $560/month

EPO: Anthem Blue Cross

Anthem Blue Cross is our top choice for the best health insurance in California with Silver EPO plans. They charge an average of $634 monthly, with a maximum out-of-pocket cost of $9,100. The provider denies claims about 22.74% of the time, which is higher than usual.

With Silver EPO plans, you can see a specialist without always needing a referral, and they’re pretty popular. However, it would help if you stuck to the doctors and hospitals in the plan’s network unless it’s an emergency.

We recommend the below Silver EPO plans from Anthem Blue Cross –

- Silver 70 EPO: $634/month

EPO: Anthem Blue Cross

Kaiser Permanente is our top choice for the best health insurance in California with Silver HMO plans. They charge an average of $512 per month, with a maximum out-of-pocket cost of $9,100. The provider denies claims about 8.45% of the time, which is lower than many others.

Silver HMO plans are a popular option and cheaper than other types. You’re required to visit doctors within your network, except during emergencies. A referral from your primary care doctor is necessary to see a specialist. These plans are great if you prefer lower monthly payments and your preferred doctors are in-network.

We recommend the below Silver HMO plans from Kaiser Permanente –

- Silver 70 HMO: $512/month

Finding your best health insurance coverage in California

When selecting California’s best health insurance plan, consider your monthly health insurance budget and your anticipated medical care requirements. Plans offering extensive coverage, such as Gold and Platinum plans, entail higher monthly costs but cover a more significant portion of your medical expenses. Conversely, plans with reduced coverage feature lower monthly premiums but provide less coverage for your healthcare needs.

Gold & Platinum plans: Best suited for complex medical conditions

If you have a severe or chronic medical condition, opting for a Gold or Platinum plan is advisable. Despite their higher monthly costs, these plans may result in savings if you require costly tests or treatments. Gold and Platinum plans typically offer the lowest deductibles, coinsurance levels, and copays.

Silver plans: Best suited for average medical conditions

Silver plans present a favourable choice for the majority of individuals as they strike a balance between affordability and comprehensive coverage. Although they come at a higher cost than Bronze plans, Silver plans entail lower out-of-pocket expenses for doctor visits. Additionally, Silver plans feature moderate deductibles, coinsurance, and copays.

Bronze & Catastrophic plans: Best suited for few medical conditions

Consider choosing a Bronze or Catastrophic plan if you maintain overall good health and possess sufficient savings to cover a substantial portion of your healthcare expenses in the event of a severe illness or injury.

Medicaid: Best for low income

If you don’t earn much money, Medicaid might be a good choice for getting health insurance that’s either free or very cheap. Usually, Medicaid can lower or even remove the costs of healthcare.

It’s not as easy to get Medicaid in California compared to other places. To qualify, you must be a parent or caregiver of a child under 21 or pregnant. Some people in foster care and under 26 can also be allowed. Additionally, if you’re elderly, blind, or disabled, you might be eligible. You’re automatically enrolled in California Medicaid if you receive Supplemental Security Income (SSI).

Cheapest health insurance plan by California county

The least expensive health insurance plan varies based on location, as the available companies and rates differ by county. In Los Angeles, where a quarter of California’s population resides, LA Care offers the most affordable Silver plan. However, Molina is the cheapest choice in San Diego, the next-largest county –

Cheapest health insurance plan by California county

| County | Cheapest plan | Monthly rate |

|---|---|---|

| Alameda | Kaiser Silver 70 HMO | $554 |

| Alpine | Molina Silver 70 HMO | $390 |

| Amador | Anthem Blue Cross Silver 70 EPO | $615 |

| Butte | Anthem Blue Cross Silver 70 EPO | $615 |

| Calaveras | Anthem Blue Cross Silver 70 EPO | $615 |

| Colusa | Anthem Blue Cross Silver 70 EPO | $615 |

| Contra Costa | Kaiser Silver 70 HMO | $561 |

| Del Norte | Anthem Blue Cross Silver 70 EPO | $615 |

| El Dorado | Aetna Silver 70 HMO | $509 |

| Fresno | Aetna Silver 70 HMO | $402 |

| Glenn | Anthem Blue Cross Silver 70 EPO | $615 |

| Humboldt | Anthem Blue Cross Silver 70 EPO | $615 |

| Imperial | Health Net Silver 70 Ambetter HMO | $458 |

| Inyo | Blue Shield Silver 70 PPO | $759 |

| Kern | Blue Shield Silver 70 PPO | $453 |

| Kings | Aetna Silver 70 HMO | $402 |

| Lake | Anthem Blue Cross Silver 70 EPO | $615 |

| Lassen | Anthem Blue Cross Silver 70 EPO | $615 |

| Los Angeles | LA Care Silver 70 HMO | $356 |

| Madera | Aetna Silver 70 HMO | $402 |

| Marin | Western Health Silver 70 HMO | $543 |

| Mariposa | Anthem Blue Cross Silver 70 EPO | $496 |

| Mendocino | Anthem Blue Cross Silver 70 EPO | $615 |

| Merced | Anthem Blue Cross Silver 70 EPO | $496 |

| Modoc | Anthem Blue Cross Silver 70 EPO | $615 |

| Mono | Blue Shield Silver 70 PPO | $759 |

| Monterey | Valley Health Silver 70 HMO | $593 |

| Napa | Western Health Silver 70 HMO | $543 |

| Nevada | Anthem Blue Cross Silver 70 EPO | $615 |

| Orange | Anthem Blue Cross Silver 70 HMO | $402 |

| Placer | Aetna Silver 70 HMO | $509 |

| Plumas | Anthem Blue Cross Silver 70 EPO | $615 |

| Riverside | LA Care Silver 70 HMO | $335 |

| Sacramento | Aetna Silver 70 HMO | $509 |

| San Benito | Valley Health Silver 70 HMO | $593 |

| San Bernardino | Inland Empire Silver 70 HMO | $385 |

| San Diego | Molina Silver 70 HMO | $390 |

| San Francisco | Anthem Blue Cross Silver 70 EPO | $604 |

| San Joaquin | Blue Shield Silver 70 Trio HMO | $482 |

| San Luis Obispo | Blue Shield Silver 70 Trio HMO | $534 |

| San Mateo | Kaiser Silver 70 HMO | $620 |

| Santa Barbara | Blue Shield Silver 70 Trio HMO | $534 |

| Santa Clara | Valley Health Silver 70 HMO | $513 |

| Santa Cruz | Kaiser Silver 70 HMO | $544 |

| Shasta | Anthem Blue Cross Silver 70 EPO | $615 |

| Sierra | Anthem Blue Cross Silver 70 EPO | $615 |

| Siskiyou | Anthem Blue Cross Silver 70 EPO | $615 |

| Solano | Western Health Silver 70 HMO | $543 |

| Sonoma | Western Health Silver 70 HMO | $543 |

| Stanislaus | Blue Shield Silver 70 Trio HMO | $482 |

| Sutter | Anthem Blue Cross Silver 70 EPO | $615 |

| Tehuma | Anthem Blue Cross Silver 70 EPO | $615 |

| Trinity | Anthem Blue Cross Silver 70 EPO | $615 |

| Tulare | Anthem Blue Cross Silver 70 EPO | $496 |

| Tuolumne | Anthem Blue Cross Silver 70 EPO | $615 |

| Ventura | Blue Shield Silver 70 Trio HMO | $534 |

| Yolo | Aetna Silver 70 HMO | $509 |

| Yuba | Kaiser Silver 70 HMO | $561 |

FAQ About Health Insurance in California

How much is health insurance per month in California

On average, people in California typically pay around $487 per person for a significant individual health insurance plan.

Which is the best health insurance in California?

California’s most affordable health insurance includes Kaiser Permanente, which offers one Silver HMO plan plan.

Can I buy my own health insurance in California?

Yes, You can purchase an individual policy from an insurance company, a licensed health insurance agent, or through Covered California, California’s Healthcare Marketplace.

Is Covered California free?

Covered California is a no-cost service that links Californians with well-known health insurance options under the Patient Protection and Affordable Care Act.

Who is not eligible for Covered California?

You cannot get a Covered California plan if you are not legally in California.