Best Health Insurance in Indiana 2024

In Indiana, finding the best health insurance plan involves considering various factors such as coverage options, network availability, and affordability. Many insurance companies provide different plans designed to fit the various needs of people and families across Indiana.

When choosing the best health insurance plan in Indiana, individuals should prioritize comprehensive coverage for essential health services, including doctor visits, hospital stays, prescription drugs, and preventive care. Plans with low deductibles and copayments can help individuals manage healthcare costs effectively.

This comprehensive guide to help you find the perfect plan to meet your healthcare needs and budget.

How much does health insurance cost in Indiana?

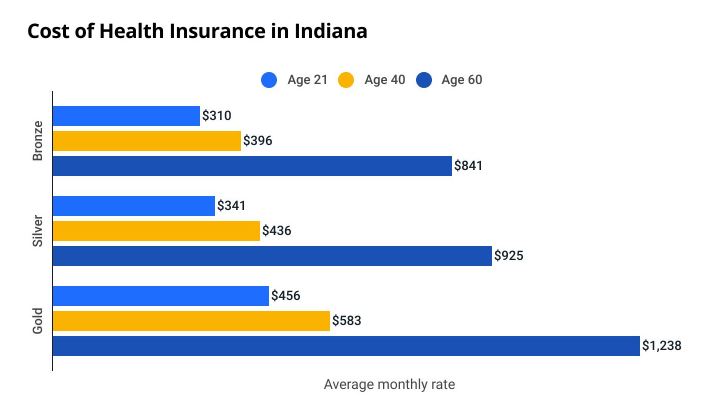

In Indiana, the average cost of a Silver health insurance plan for a 40-year-old is $436 per month.

A Gold plan, which is a higher tier, usually has higher monthly costs compared to lower-tier plans like Bronze and Silver.

With higher plan tiers, you’ll pay more each month, but you’ll spend less when you see the doctor or get medicine.

Your age plays a big role in how much you pay for health insurance. Rates start low and go up quickly as you get older. In Indiana, a 60-year-old will pay over twice as much as a 40-year-old for the same coverage in all plan tiers.

Overall Best Health Insurance in Indiana

Ambetter is rated as the top health insurance provider in Indiana. It has low out-of-pocket costs, rejects fewer claims than usual, and offers affordable plans.

We looked at 37 Silver plans in Indiana, including both EPO and HMO types, for this assessment.

Ambetter

Our top choice for the best health insurance in Indiana is Ambetter. They offer 10 Silver EPO plans, with an average monthly rate of $445. These plans have an average maximum out-of-pocket cost of $7,830.

Ambetter only offers Silver EPO plans. With EPO plans, members can usually see specialists without needing a referral, making it simpler to get the care they require.

Ambetter has a denial rate of approximately 15%, which is lower than many other insurance providers.

- Extremely low denial rates in claims.

- Profitable maximum out-of-pocket fees.

- Limited plan options

Plan Recommendations:

We recommend the following Silver plans:

- Standard Silver: $430/month; MOOP $5,400

- Clear Silver: $432/month; MOOP $5,400

- Focused Silver: $438/month; MOOP $8,000

Best Health Insurance in Indiana for Low Out-of-Pocket Costs

Ambetter is the best health insurance in Indiana for low out-of-pocket expenses. It offers the most affordable plan choices, with lower out-of-pocket costs and fewer claim denials compared to other insurers. We looked at 21 Gold EPO and Gold HMO plans to decide Ambetter as the best health insurance in Indiana for low out-of-pocket expenses.

Ambetter

Our top choice for the best health insurance in Indiana with low out-of-pocket costs is Ambetter. They provide eight Gold EPO plans. EPO plans usually offer lower premiums if you use doctors and hospitals within the plan’s network.

Their plans have an average monthly rate of $559, and the average maximum out-of-pocket cost is $7,300.

Ambetter’s denial rate is 14.84%, which is lower than many other insurance companies.

- Offers reasonable premium rates.

- Lower out-of-pocket costs.

- Very low denies claims.

- Limited plan options

Plan Recommendations:

We recommend the following Silver plans:

- Elite Gold: $596/month; MOOP $5,500

- Everyday Gold: $524/month; MOOP $7,500

- Elite Gold + Vision + Adult Dental: $619/month; MOOP $5,500

Best Cheap Health Insurance in Indiana

Anthem (BCBS) is rated as the top affordable option for health insurance in Indiana.

Anthem offers the cheapest plan choices, with lower-than-average out-of-pocket costs, and experiences fewer claim denials compared to many other providers.

For this assessment, we examined 18 Silver EPO plans and 19 Silver HMO plans in Indiana. Plans with lower monthly costs were given more importance, but usually, these plans may require you to pay more out of pocket when you use healthcare services.

Anthem (BCBS)

Our top choice for affordable health insurance in Indiana is Anthem (BCBS). They offer five Silver plans.

Anthem offers HMO Silver plans in Indiana. With these plans, you might need to select a primary care doctor and get referrals to see specialists.

Their plans have an average monthly rate of $416, and the average maximum out-of-pocket cost is $8,070.

Anthem’s denial rate is 23%, which is lower than many other insurance companies.

- Cheap premium rates.

- Lower out-of-pocket maximum costs.

- Very low denies claims.

Plan Recommendations:

We recommend the following Silver plans:

- Anthem Silver Pathway Essentials 7200 ($0 Virtual Care): $395/month; MOOP $8,700

- Anthem Silver Pathway Essentials 5900 Standard: $406/month; MOOP $9,100

- Anthem Silver Pathway Essentials 5000 ($0 Virtual Care): $415/month; MOOP $7,500

Best Health Insurance for Low Income in Indiana

Anthem (BCBS) has the top health insurance in Indiana for people with low income. Their rates are below average, they have fewer out-of-pocket costs compared to many others, and they don’t deny claims as often as other providers.

In Indiana, we examined 18 Silver EPO plans and 19 Silver HMO plans to identify the top choices for people with low income.

We selected the finest health insurance for individuals with low income by seeking plans with affordable monthly fees and offering cost-sharing reductions (CSRs). CSRs help lower the amount you have to pay when you visit the doctor or hospital if you don’t earn much money. Regular Silver plans cover around 70% of healthcare costs, but CSR Silver plans cover even more:

- If you earn between $27,180 and $33,975 annually (which is 201–250% of the federal poverty level), around 73% of your health insurance expenses will be covered.

- For those making $20,385 to $27,180 per year (151–200% of FPL), approximately 87% of costs will be covered.

- If your yearly income is less than $20,385 (up to 150% of FPL), you can anticipate around 94% of your expenses being covered.

The income eligibility for these benefits varies based on the size of your family.

Anthem

Our top choice for the best health insurance in Indiana for individuals with low income is Anthem (BCBS). They offer plans that are affordable for those earning below 250% of the federal poverty level.

Anthem provides five Silver CSR plans, with an average monthly cost of $416 and an average maximum out-of-pocket (MOOP) expense of $6,940.

Although Anthem doesn’t provide PPO or POS plans, their EPO plans generally have lower premiums, which can be advantageous for policyholders. However, the company tends to deny claims more frequently compared to its competitors.

- Affordable premium rates.

- Extremely low denial rates in claims.

- Fewer plan types are offered.

Plan Recommendations:

Anthem’s highest-rated plan provides reduced out-of-pocket expenses for the same premium, regardless of people’s income levels. Here are some examples of the lower overall out-of-pocket costs based on income levels:

- 151-200% of the FPL: $395/month; $2,600 MOOP

- Up to 150% of the FPL: $395/month; $750 MOOP

Best Health Insurance for Young Adults in Indiana

Aetna offers the top health insurance in Indiana for young adults. Aetna’s plans have some of the lowest rates, minimal out-of-pocket expenses, and a good track record of approving claims more often than other companies. It’s important to note that Catastrophic plans are only available to individuals under 30 years old.

For this evaluation, we reviewed four Bronze HMO plans, 16 Expanded Bronze EPO plans, nine Expanded Bronze HMO plans, and two Expanded Bronze POS plans in Indiana.

Aetna

Aetna is the top choice for young adults seeking health insurance in Indiana. They provide three Expanded Bronze plans, which are suitable for individuals needing less medical care. There is no mention of Catastrophic or Bronze plans from the best provider.

Aetna doesn’t have PPO or POS plans in Indiana. One advantage of EPO plans is that they often have lower premiums while still offering quality care within a network of doctors and hospitals.

Their plans have an average monthly rate of $290, and the average maximum out-of-pocket cost is $8,767. Aetna has a denial rate of 21%, which is lower than most other companies.

- Reasonable premiums.

- Low out-of-pocket maximum costs.

- Frequently denies claims.

- Limited plan options.

Plan Recommendations:

We recommend the following Best Health Insurance for Young Adults in Indiana:

- Bronze 2 HSA: Aetna network of doctors & hospitals:

- $258/month for 18 year olds

- $290/month for 26 year olds

- Bronze S: Aetna network of doctors & hospitals:

- $263/month for 18 year olds

- $295/month for 26 year olds

- Bronze 4: Aetna network of doctors & hospitals:

- $269/month for 18 year olds

- $301/month for 26 year olds

Best Health Insurance by Plan Type in Indiana

Health insurance companies offer various types of plans. The top providers in each plan category are:

- EPO: Ambetter

- HMO: Anthem (BCBS)

Silver plans were selected for these recommendations because they strike a balance between monthly payments and healthcare costs when you need it. Silver plans are suitable for people who frequently visit the doctor or require medication.

In Indiana, you have 18 Silver EPO plans and 19 Silver HMO plans to choose from.

EPO: Ambetter

Our top pick for the best health insurance in Indiana among Silver EPO plans is Ambetter. They offer 10 plans with an average monthly rate of $445 and an average maximum out-of-pocket cost of $7,830. Ambetter also has a low denial rate of around 15%.

Silver EPO plans have both positives and negatives. They’re quite popular, ranking as the third most common plan type. One advantage is that you typically don’t need a referral to see a specialist, which makes accessing care easier.

However, similar to HMOs, you’re generally required to stick to Ambetter’s network for your healthcare, unless it’s an emergency, limiting your choices somewhat.

Plan Recommendations:

- Clear Silver: $432/month

- Clear Silver + Vision + Adult Dental: $449/ month

HMO: Anthem

Our top choice for the best health insurance in Indiana among Silver HMO plans is Anthem (BCBS). They offer five different HMO plans.

These plans have an average monthly cost of $416, with an average maximum out-of-pocket cost of $8,070. However, the provider has a denial rate of 22.74%, which is higher than average.

Silver HMO plans are more affordable compared to other plan types. Typically, you need to select doctors within the plan’s network, except in emergencies. You may also need permission from your primary doctor to see a specialist. These plans are beneficial for saving money each month if you can use doctors within the plan’s network.

We recommend the following Silver HMO plans from Anthem (BCBS):

- Anthem Silver Pathway Essentials 4000 HSA: $441/month

- Anthem Silver Pathway Essentials 5000 ($0 Virtual Visits): $415/month

Best Short-Term Health Insurance in Indiana

With a MoneyGeek score of 95 out of 100, National General Accident & Health is the top short-term health insurance provider in Indiana. Short-term health insurance is a great option if you need coverage for temporary gaps. It’s usually cheaper because it doesn’t cover all the essential health benefits required by the Affordable Care Act (ACA).

NATIONAL GENERAL ACCIDENT & HEALTH

National General Accident & Health is our top choice if you need short-term coverage because it provides the highest coverage limits available.

It offers flexible contract terms, ranging from as short as three months to as long as three years.

How to Find the Best Health Insurance for You in Indiana

The best health insurance provider in Indiana varies for each person based on their budget and healthcare needs. You might need to figure out how much you can afford to pay each month and find a plan that fits your needs.

Explore different methods for shopping for health insurance:

Understand when a health insurance plan will cover you

Health insurance can have different rules about where you can get care. “In-network” means doctors and hospitals have a deal with your insurance to charge less. “Out-of-network” doesn’t have this deal, so they can charge more. Some plans let you see any doctor, while others only cover visits to specific doctors.

In Indiana, plans with flexible doctor choices are less common. Plans that only cover specific doctors are more common but might be cheaper.

Indiana offers 18 EPO plans and 19 HMO plans.

Weigh the cost of premiums vs. the cost of care

When choosing health insurance, consider a plan that fits your needs. Think about your monthly payments and potential yearly medical expenses.

Some plans have low monthly payments but high costs for medical services. Others cost more monthly but could save you money if you visit the doctor often.

For example, Ambetter’s Clear Silver plan has a lower maximum out-of-pocket cost ($5,400) compared to its other Silver plans. Although its monthly cost ($432) is higher than average, it offers good medical service options.

Consider Indiana Medicare or Medicaid if You’re Eligible

If you’re 65 or older or have a qualifying illness or disability, you can consider Medicare. It’s a federal health insurance program that provides financial help for healthcare services. Medicare has different parts:

- Part A (Hospital Insurance): Covers hospital stays, skilled nursing facilities, hospice care, lab tests, and surgeries.

- Part B (Medical Insurance): Covers doctor visits, home health care, preventive services, and durable medical equipment for outpatient care.

- Part D (Prescription drug coverage): Pays the prescribed medication cost.

Besides Medicare, there’s another government program called Medicaid to assist low-income individuals with coverage. If your income is below 133% of the Federal Poverty Level (FPL) for your household size, you might qualify for Medicaid.

FAQ About Health Insurance in Indiana

What is the best health insurance provider in Indiana for 2024?

Ambetter is the best health insurance in Indiana for 2024. Your best choice depends on your specific circumstances and needs.

How much is health insurance in Indiana per month?

In Indiana, your health insurance costs increase as your family size grows. On average, a single parent with a child can expect to pay $697 per month for coverage.

Does Indiana have state health insurance?

The Healthy Indiana Plan is a health insurance program for eligible adults provided by the State of Indiana.

Does Indiana have low income health insurance?

Yes, Indiana provides various health coverage options for eligible low-income individuals and families, as well as individuals with disabilities and elderly individuals with limited financial resources.

Who is eligible for Healthy Indiana Plan?

The plan provides coverage for individuals aged 19 to 64 who meet certain income requirements.