Your Guide to Finding the Best Health Insurance in Arkansas 2024

Are you seeking the best health insurance options in Arkansas? Look no further. In this guide, we’ll explore the top health insurance providers in the state, their coverage options, and what sets them apart.

From affordable premiums to comprehensive coverage, we’ll help you navigate the landscape of health insurance in Arkansas so you can make an informed decision that meets your needs and budget.

Whether you’re an individual, a family, or a business owner, finding the right health insurance plan is crucial for your well-being. Let’s dive into the details and find the best health insurance in Arkansas.

How much does health insurance cost in Arkansas?

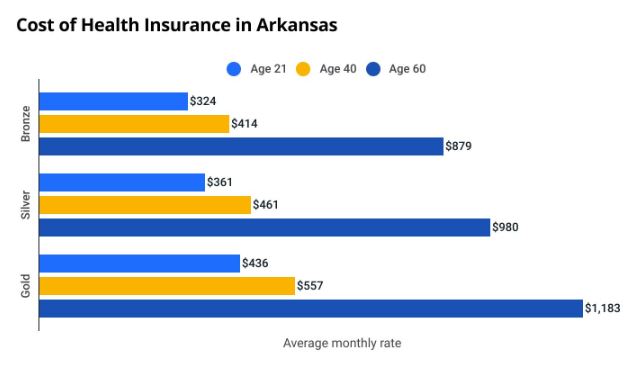

In Arkansas, the average cost of health insurance is $461 for a 40-year-old with a Silver plan. Silver plans offer decent coverage at a reasonable price. Bronze plans are less expensive, but you’ll pay more out-of-pocket when you visit the doctor.

In Arkansas, factors like your location, the number of people covered by your insurance, whether you smoke or use tobacco, the type of plan you choose, and your age all impact how much you’ll pay for health insurance. For instance, a 60-year-old with a Silver plan pays nearly three times as much as a 21-year-old with the same coverage.

Overall Best Health Insurance in Arkansas

Octave is ranked as the best health insurance provider in Arkansas. Octave offers affordable plan choices that keep out-of-pocket expenses low for individuals. Additionally, it seldom denies claims for healthcare services compared to its competitors.

We examined 25 Silver plans in Arkansas, including POS and PPO plan options for our assessment.

Octave

Our top choice for the best health insurance in Arkansas is Octave. The provider offers two Silver POS plans with an average monthly rate of $474. The average maximum out-of-pocket (MOOP) cost for these plans is $7,625.

Octave’s Silver POS plans to provide extensive out-of-network coverage. It offers an average plan rate of $454, with the average MOOP cost for these plans also being $7,625. Octave boasts a denial rate of 0%, which is significantly better than most of its competitors.

- Fewer claims denied

- Lower out-of-pocket maximum

- Affordable premium rates

- Wide range of plan types

We recommend the following Octave Silver plans:

- Octave Silver AH: $474/month

- Octave Silver Standardized: $435/month

Best Health Insurance in Arkansas for Low Out-of-Pocket Costs

Ambetter offers the best health insurance in Arkansas for low out-of-pocket costs. They provide:

- Affordable plan options.

- Low out-of-pocket costs.

- A better-than-average approval rate for claims.

For this analysis, we examined four Gold POS and nine Gold PPO plans in Arkansas.

Ambetter

Our top choice for the best health insurance in Arkansas for low out-of-pocket costs is Ambetter. They provide eight Gold PPO plans and two Gold POS plans, which are great for lower maximum out-of-pocket expenses.

These PPO and POS plans typically offer more out-of-network coverage, giving you more options for doctors and hospitals. Ambetter has an average plan rate of $547, and the average maximum out-of-pocket cost for these plans is $7,580.

Additionally, Ambetter has a denial rate of 15%, lower than most competitors.

- Reasonable premiums

- Lower out-of-pocket maximum costs

- A diverse range of plan options

- There is a high likelihood of claim denial

We recommend the below-mentioned Gold and Platinum plans:

- Everyday Gold: $509/month

- Elite Gold (QualChoiceLife): $615/month

- Everyday Gold + Vision + Adult Dental: $531/month

Best Cheap Health Insurance in Arkansas

Octave is Arkansas’s top choice for affordable health insurance. They provide plans with low rates and lower-than-average out-of-pocket expenses. Additionally, Octave denies fewer claims compared to most other providers.

For this analysis, we reviewed 25 Silver plans in Arkansas, including seven Silver POS and 18 Silver PPO plans. They were given priority to determine the best affordable provider plans with lower monthly premiums, even though lower premiums often mean higher out-of-pocket costs.

Octave

Our top choice for affordable health insurance in Arkansas is Octave. They offer two Silver plans for individuals seeking to save money on healthcare.

Octave’s Silver plans are POS plans, which may provide more flexibility to visit doctors and hospitals outside the network. They have an average plan rate of $454, with an average maximum out-of-pocket cost of $7,625.

Octave also boasts a denial rate of 0%, which is lower than most competitors.

- Lower out-of-pocket maximum expenses

- Few claims denied

- Diverse plan options are available

We recommend the below-mentioned cheap Silver plans:

- Octave Silver Standardized: $435/month

- Octave Silver AH: $474/month

Best Health Insurance for Low Income in Arkansas

Octave offers the best health insurance in Arkansas for low-income people. They provide plans with lower rates and low out-of-pocket costs and deny fewer claims compared to other providers.

We examined 25 Silver CSR plans in Arkansas, including seven POS and 18 PPO plans. MoneyGeek focused on Silver CSR plans that help save money on monthly costs. These plans come with cost-sharing reductions if you earn less money, meaning you don’t have to pay as much when you get medical care.

A regular Silver plan typically covers about 70% of your healthcare costs. However, with a Silver CSR plan, you can cover more expenses if you make less money. Here’s what you could expect:

- If you earn between $27,180 and $33,975 annually, your plan could cover about 73% of your healthcare costs.

- If you make between $20,385 and $27,180 annually, your plan could cover about 87% of your costs.

- If you make less than $20,385 annually, your plan could cover about 94% of your costs.

These percentages could vary depending on the size of your family.

Octave

Octave is our top choice for the best health insurance in Arkansas for those with low income. They offer affordable plans for individuals below 250% of the federal poverty level (FPL). Octave provides two Silver CSR plans with an average rate of $454 per month. The average maximum out-of-pocket (MOOP) cost for these plans is $6,213.

Octave doesn’t offer PPO or POS plans, which usually have more out-of-network coverage. However, they offer EPO plans, which typically have lower monthly costs.

Additionally, the company’s denial rate is 0%, meaning they approve claims more often than competitors.

- Lower out-of-pocket maximum expenses

- Few claims denied

- Diverse plan options are available

Below are examples of lower overall out-of-pocket expenses based on income levels:

- 201%–250% of the FPL: $435/month

- 151%–200% of the FPL: $435/month

- Up to 150% of the FPL: $435/month

Best Health Insurance for Young Adults in Arkansas

Octave offers the top health insurance for young adults in Arkansas. They provide plans with reduced out-of-pocket expenses and higher-than-average approval rates for claims. Catastrophic coverage is available only for individuals under 30 years old.

We examined six Expanded Bronze POS plans and eight Expanded Bronze PPO plans for this evaluation.

Octave

Octave is our top choice for Arkansas’s best health insurance for young adults. They offer two Expanded Bronze plans with an average monthly rate of $318 and an average maximum out-of-pocket cost of $9,100.

Although Octave doesn’t offer PPO plans, they provide POS plans. POS plans still allow you to choose doctors and offer some out-of-network coverage.

Additionally, the company’s denial rate is 0%, meaning they approve claims more often than competitors.

- Fewer claims denied

- Lower out-of-pocket costs

- Fewer types of plans

Below are examples of lower overall out-of-pocket expenses based on income levels:

- Octave Bronze Value:

- $299/month for 18 year olds

- $336/month for 26 year olds

- Octave Bronze Exp Standardized

- $267/month for 18 year olds

- $300/month for 26 year olds

Best Health Insurance in Arkansas by Plan Type

Health insurance companies offer various plans. In Arkansas, the top providers for all available plan types are:

- PPO: Ambetter

- POS: Octave

These recommendations are based on Silver plans. Silver plans are popular because they help balance your monthly costs when you visit the doctor. They’re suitable for individuals who don’t need frequent doctor visits.

Arkansas offers 18 Silver PPO plans, and seven Silver POS plans for you to choose from.

Ambetter

Our top choice for the best health insurance in Arkansas for Silver PPO plans is Ambetter. They offer thirteen Silver PPO plans with an average monthly rate of $448 and an average maximum out-of-pocket cost of $8,742. Ambetter has a denial rate of 15%, meaning they reject fewer claims than average.

PPO plans, like the Silver ones from Ambetter, allow you to select your doctors without needing a specialist referral. PPO plans are standard in Arkansas. However, they can be more expensive than other types, so it’s essential to consider them if you want to save money.

We recommend the below-mentioned Ambetter Silver PPO plans:

- Focused Silver: $433/month

- Focused Silver + Vision + Adult Dental: $452/month

Health Insurance Costs in Arkansas by Age and Metal Tier

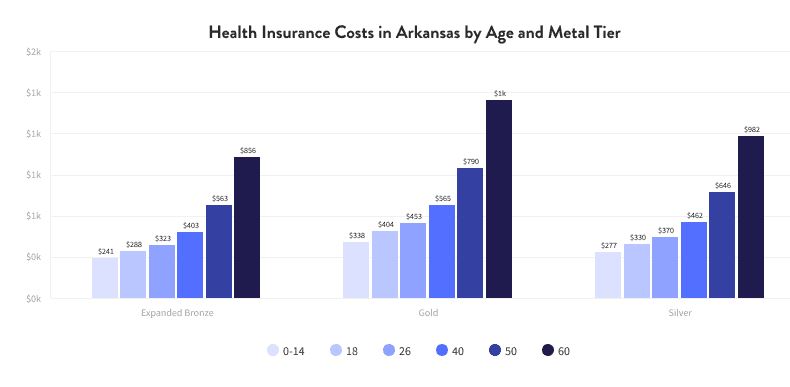

Age significantly affects how much you pay for health insurance in Arkansas. For example, an 18-year-old pays around $330 monthly for a Silver plan, while a 60-year-old must pay approximately $982. That’s a $652 difference each month.

Metal tiers determine how you split the costs of your care with your insurer. A 40-year-old in Arkansas with a Bronze plan pays about $403 monthly. However, if they opt for a Gold plan instead, they’ll pay around $565 monthly. So, the Gold plan costs $162 more monthly because it covers more medical expenses.

Know More About Health Insurance in Arkansas

We analyzed all the health insurance choices in Arkansas. We looked at private insurance in the marketplace, which comes in different metal levels like Expanded Bronze, Silver, and Gold. Our team also explored eligibility for Medicaid and Medicare. Our goal is to help you understand your options so you can choose the proper healthcare for yourself.

Private Health Insurance in the Arkansas Marketplace:

In Arkansas, the open enrollment period for private health insurance usually starts on November 1 and ends on December 15 each year. During this time, residents can shop for, compare, and buy health insurance plans through the Health Insurance Marketplace.

If you miss the deadline, you may have to wait until the next open enrollment period unless you qualify for a Special Enrollment Period due to certain life events like getting married, having a baby, or losing other coverage. If eligible, you can only enrol or change plans outside the regular enrollment period. Meanwhile, enrollment for Medicaid or the Children’s Health Insurance Program (CHIP) is open all year round.

Medicaid in Arkansas:

Medicaid is a health care program in the United States that helps low-income individuals and families access medical assistance. Federal and state governments fund it and cover various services like doctor visits, hospital care, long-term care, and preventive services.

In Arkansas, eligibility for Medicaid depends on factors such as income, family size, and age. Pregnant women, children, elderly adults, and individuals with disabilities may qualify.

Arkansas also expanded Medicaid under the Affordable Care Act, allowing adults with incomes up to 138% of the federal poverty level to be eligible. Enrollment is ongoing with no specific enrollment period.

Medicare in Arkansas:

Medicare is a federal health insurance program for people who are 65 or older, certain younger individuals with disabilities, and people with specific severe conditions like End-Stage Renal Disease.

In Arkansas, residents who meet these conditions are eligible.

- Medicare Part A covers inpatient hospital care, skilled nursing care, hospice, and home health care.

- Part B covers doctors’ services, outpatient care, medical supplies, and preventive services.

- Part C, or Medicare Advantage, includes all benefits and services covered under Parts A and B, and may offer additional benefits and services.

- Part D covers prescription drugs.

FAQs about the best health insurance in Arkansas

What is the average cost of health insurance in Arkansas?

The average price of health insurance in Arkansas is $6,653 per person, according to the most recent data available.

How much does health insurance cost in Arkansas?

Costs vary greatly depending on factors like age, health status, plan type, and location.

- Individual plans: Average between $300-$700 per month.

- Family plans: Can range from $800-$1,500+ per month.

Does Arkansas have affordable health care?

Yes, Arkansas residents can apply for Affordable Care Act (ACA) health insurance in Arkansas during the annual Open Enrollment Period.

Does Arkansas have good healthcare?

Despite this impressive record, Arkansas consistently ranks among the lowest in the nation for healthcare.

How much is private health insurance in Arkansas?

In Arkansas, the average monthly cost of a Silver health insurance policy for a family of three is $1,200. Adding each child to your plan costs an average of $276 monthly. Additionally, the ages of the individuals on your plan impact your monthly payments