Best Health Insurance Companies & Plans in New Jersey 2024

When it comes to finding the best health insurance in New Jersey, can be challenging. Whether you’re a single adult, part of a family, or an individual seeking coverage, the best health insurance in New Jersey offers a variety of options suiting different needs and budgets.

For families, the best health insurance in New Jersey often involves vast coverage suiting the diverse needs of each family member. Horizon BCBSNJ, AmeriHealth NJ, and Oscar Health are popular choices for families, offering diverse benefits and network options to ensure quality care when needed.

For single adults, opt for plans balancing affordability and coverage. Horizon BCBSNJ and Oscar Health offer individual plans with broad provider networks and affordable premiums.

Individuals in New Jersey seeking health insurance have several options to consider. Whether you’re a freelancer, self-employed, or without employer-sponsored coverage, individual plans offer competitive rates and comprehensive coverage options.

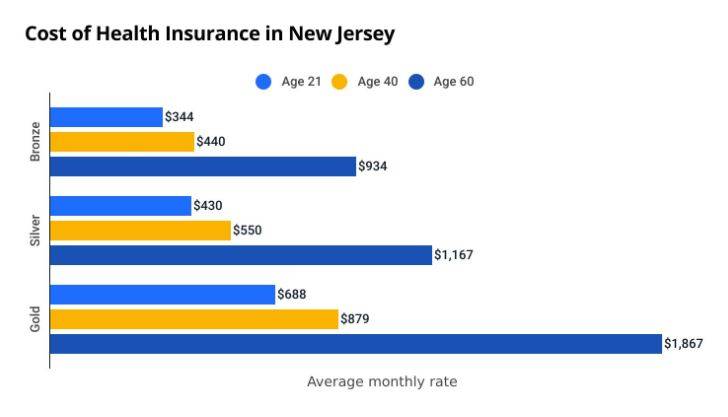

The cost of health insurance in New Jersey varies based on factors like age, income, and coverage level, ranging from several hundred to over a thousand dollars per month on average.

This complete guide to help you find the perfect plan to meet your healthcare needs and budget.

How much does health insurance cost in New Jersey?

In New Jersey, the typical price for health insurance is about $550 per month if you’re 40 and choose a Silver plan. Your monthly cost depends a lot on the coverage level you pick. If you go for a plan with more coverage, such as Gold, it usually means higher monthly payments.

As you get older, your health insurance costs go up. A 60-year-old pays around $600 more each month for a Silver plan than a 40-year-old.

Best Overall for Health Insurance in New Jersey

AmeriHealth stands out as the top health insurance provider in New Jersey, offering comprehensive coverage, wide acceptance, reasonable costs, and various plan options. On average, its monthly premium is $642.

AmeriHealth is rated the best health insurance provider in New Jersey. They offer affordable plans with low maximum out-of-pocket costs and efficient claims processing.

AmeriHealth

AmeriHealth offers various health insurance plans for individuals, families, and employers in New Jersey. As a part of the AmeriHealth Caritas Family of Companies, they play a significant role in Medicaid-managed care.

AmeriHealth stands out as the top choice for health insurance in New Jersey. With 60 Silver EPO plans available, it boasts the lowest average maximum out-of-pocket cost at $8,042. While its average premium of $642 isn’t the cheapest, AmeriHealth boasts a 0% claims denial rate, ensuring your legitimate claims are likely to be accepted.

- They have an extensive network of providers across New Jersey.

- Diverse plans ranging from HMO, POS, and PPO.

- AmeriHealth programs help people reduce their insurance costs.

- Limited Medicare Advantage Options.

- Plan costs can vary significantly.

Recommend Plan:

- IHC Select Silver EPO HSA AmeriHealth Hospital Advantage $50/$75: $432/month

- IHC Silver EPO HSA Local Value $50/$75: $590/month

- IHC Silver EPO HSA AmeriHealth Hospital Advantage $50/$75: $483/month

Best Health Insurance in New Jersey for Low Out-of-Pocket Costs

Aetna is the top choice for low maximum out-of-pocket (MOOP) costs in New Jersey. It has a high approval rate for claims and provides some of the most affordable plans with low MOOP costs.

Aetna

For individuals seeking low maximum out-of-pocket (MOOP) costs in New Jersey, Aetna is the top choice. They offer 15 Gold EPO plans with an average monthly cost of $709. With an average MOOP of $7,000, Aetna rarely rejects claims, ensuring approval for legitimate claims.

Aetna offers a variety of individual and family health insurance plans, including HMO, PPO, and POS plans. They have a wide network of doctors and hospitals, and their plans are generally considered to be affordable

- Extensive network of healthcare providers.

- Diverse individual and family plans with bronze, silver, gold, and platinum tiers.

- Offer preventive health with programs and resources.

- Premiums can be higher.

- Some plans have high deductibles and copays.

Recommend Plan:

- Gold: Aetna Whole Health network: $709/monthly

- Gold: Aetna Whole Health network + Ped Dental: $710/monthly

Best Cheap Health Insurance in New Jersey

AmeriHealth is the top choice for affordable health insurance in New Jersey. We selected this provider by reviewing plans with low monthly premiums. Choosing lower premium plans may lead to higher out-of-pocket costs. We examined 205 EPO plans for this category.

AmeriHealth

We found that AmeriHealth offers the most affordable health insurance in New Jersey.

Their plans average $642 per month, with a low average maximum out-of-pocket (MOOP) of $8,042.

While they have only eight EPO plans available, you can trust that your claims won’t be denied, as they have a 0% claims denial rate.

- Lowest MOOP.

- Lowest claims denial rate.

- AmeriHealth programs help people reduce their insurance costs.

- Only EPO plans are available.

- Plan costs can vary significantly.

Recommend Plan:

- IHC Select Silver EPO HSA AmeriHealth Hospital Advantage $50/$75: $432/monthly

- IHC Silver EPO HSA AmeriHealth Hospital Advantage $50/$75: $438/monthly

- IHC Silver EPO HSA Local Value $50/$75: $590/monthly

Best Health Insurance for Young Adults in New Jersey

Aetna provides top health insurance for young adults in New Jersey. Our evaluation focused on insurers offering Bronze or Catastrophic plans, which are budget-friendly but come with higher out-of-pocket expenses. Catastrophic plans are limited to those under 30. We reviewed 105 Bronze EPO plans and 12 Catastrophic EPO plans for this category.

Aetna

We found that young adults can get great value from Aetna’s health plans.

They have the lowest average cost at $291, along with the lowest maximum out-of-pocket (MOOP) cost of $7,925. Aetna offers 30 Bronze EPO plans statewide.

Additionally, Aetna received the highest score for claims approval, meaning they’re unlikely to deny your claims.

- Lowest monthly costs.

- Lowest maximum out-of-pocket.

- Never denies legitimate claims.

- Only offer EPO plans.

- Premiums can be higher.

Recommend Plan:

- Bronze: Aetna Whole Health network HDHP:

- $254/month for 18-year-old

- $285/month for a 26-year-old

- Bronze: Aetna Whole Health network HDHP + Ped Dental:

- $254/month for 18-year-old

- $285/month for a 26-year-old

- Bronze: Aetna Whole Health network

- $265/month for 18-year-old

- $297/month for a 26-year-old

Factors to Consider When Choosing Health Insurance in NJ

The best health insurance is like Goldilocks’ porridge – not too expensive, not too cheap, but just right for YOU!

While finding the perfect health insurance in NJ should consider:

- Choose an insurer with a large network and a customer-friendly claims process.

- Look for an organization that offers group plans.

- Check your eligibility for a special enrollment period and discount offers.

- Health insurance protects your wallet, not just your health. Don’t skip it because of cost, big medical bills can really hurt your finances!

Consider New Jersey Medicare or Medicaid if Eligible

Elderly people in New Jersey aged 65 and above or those with qualifying illnesses or disabilities can enroll in Medicare. This federal government program assists eligible individuals in obtaining health coverage.

Medicare comprises the following components:

- Part A: Typically covers expenses of hospital stays, including skilled nursing facility care, inpatient care, and home health care services.

- Part B: Covers the costs associated with outpatient care, medical services, and preventive care.

- Part D: Covers the expenses for recommended vaccines and prescription medications.

Additionally, individuals with income below 138% of the Federal Poverty Level can choose to enroll in Medicaid.

Cheapest health insurance plan by New Jersey county

Aetna Silver 1 stands out as the top affordable option for many individuals in New Jersey. However, in certain counties neighboring New York City, Horizon BCBS offers the most economical Silver plan.

Your location determines the available plan options. Some insurers offer plans only in specific regions, while others cover the entire state. Comparing your choices is key to finding the most affordable plan.

Cheapest health insurance plan by NJ county

| County | Cheapest plan | Monthly rates |

|---|---|---|

| Atlantic | Aetna Silver 1 | $458 |

| Bergen | Aetna Silver 1 | $458 |

| Burlington | Aetna Silver 1 | $458 |

| Camden | Aetna Silver 1 | $458 |

| Cape May | Aetna Silver 1 | $458 |

| Cumberland | Aetna Silver 1 | $458 |

| Essex | Aetna Silver 1 | $458 |

| Gloucester | Aetna Silver 1 | $458 |

| Hudson | Aetna Silver 1 | $458 |

| Hunterdon | Aetna Silver 1 | $458 |

| Mercer | Aetna Silver 1 | $458 |

| Middlesex | Aetna Silver 1 | $458 |

| Monmouth | Horizon BCBS Silver Value | $461 |

| Morris | Aetna Silver 1 | $458 |

| Ocean | Horizon BCBS Silver Value | $461 |

| Passaic | Aetna Silver 1 | $458 |

| Salem | Aetna Silver 1 | $458 |

| Somerset | Aetna Silver 1 | $458 |

| Sussex | Aetna Silver 1 | $458 |

| Union | Aetna Silver 1 | $458 |

| Warren | Aetna Silver 1 | $458 |

FAQs About Best Health Insurance in NJ

What is the largest health insurance company in New Jersey?

Horizon Blue Cross Blue Shield of New Jersey is the largest health insurance company in the state, providing coverage to over 3.6 million members.

What is the cheapest medical insurance in NJ?

AmeriHealth offers the most affordable Bronze plan in the state, while Ambetter from WellCare provides the least expensive Gold plan.

What is the maximum income to qualify for NJ FamilyCare?

To be eligible for NJ FamilyCare as an adult, the entire family’s income must not exceed 138% of the Federal Poverty Level. For a single individual, this amounts to $1,677 per month, and for a family of four, it’s $3,450 per month (as per 2023 guidelines).

Does New Jersey have free healthcare for low income?

Yes, Residents of New Jersey who meet the qualifications may be eligible for healthcare coverage at no cost or at a reduced cost.

Why am I not eligible to get covered nj?

Typically, if you are already enrolled in or eligible for other forms of minimum essential coverage, you may not qualify for financial assistance from Get Covered New Jersey.