Best Health Insurance in Florida (2024)

No matter who you are, having medical insurance will inevitably become essential at some stage in life. Whether it’s for routine check-ups or unexpected medical procedures, every individual requires coverage through an insurance policy.

This is where the confusion begins. With numerous plans and companies available, it’s easy to become overwhelmed, particularly if you’re new to shopping for a medical insurance plan.

So learn more about the top health insurance companies in Florida to positively impact your life and your family’s well-being. Discover these insights in our upcoming article on MyMercys.

Countless companies offer excellent medical insurance in Florida, but selecting one should align with your specific needs.

The medical insurance cost is influenced by various factors, including the individual’s age and several others. These additional factors encompass health status and medical history, existing coverage and benefits, the type of plan selected (individual or family), and the state of residence.

Choosing the proper medical insurance company in Florida is crucial.

This guide will help in finding the top-rated and most budget-friendly health insurance plans in Florida. Let’s explore…

How much does health insurance cost in Florida?

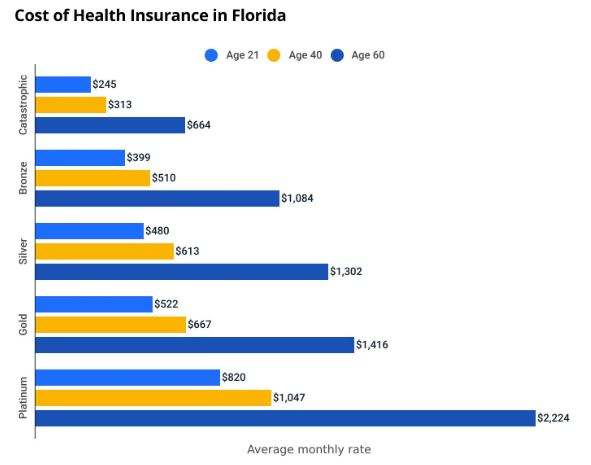

For a 40-year-old individual in Florida, a Silver plan, often suitable for those with typical medical requirements, averages $613 per month. Your choice of coverage level significantly influences the cost of health insurance. Plans offering greater coverage, such as Gold and Platinum, generally incur higher monthly costs compared to those with less coverage, such as Catastrophic and Bronze plans.

Age also impacts health insurance premiums in Florida. As you grow older, your monthly payments increase. This is because older individuals are more prone to health issues, resulting in higher claims paid by health insurance companies.

Cheapest health insurance in Florida

The Standard Silver plan offered by Ambetter stands as the most affordable Silver health insurance choice in FL, priced at just $440 per month (before subsidies). Additionally, Ambetter proves to be the least expensive option for Bronze and Gold plans as well.

Below, you’ll find Florida’s most cost-effective health insurance plans from each metal tier:

| Tier | Cheapest Plan | Monthly Cost |

|---|---|---|

| Catastrophic | Health First Catastrophic | $231 |

| Bronze | Ambetter Standard Expanded Bronze | $348 |

| Silver | Ambetter Standard Silver | $440 |

| Gold | Ambetter Standard Gold | $413 |

| Platinum | Florida Health Care Gym Access Platinum | $691 |

You can purchase health insurance in Florida on HealthCare.gov from Nov. 1 to Jan. 15 annually. This period is known as health insurance open enrollment, during which most individuals opt to either renew their existing plan or switch to a new one.

If you’ve experienced a significant life event such as moving, having a baby, getting married, losing health coverage from your job, or undergoing any other qualifying life change, you may be eligible for a special enrollment period. This allows you to enroll in health insurance outside of the Nov. 1 to Jan. 15 time period.

Finding your best health insurance coverage in Florida

When selecting the best health insurance plan in Florida, consider your monthly health insurance budget and your anticipated medical care requirements. Plans offering extensive coverage, such as Gold and Platinum plans, entail higher monthly costs but cover a greater portion of your medical expenses. Conversely, plans with reduced coverage feature lower monthly premiums but provide less coverage for your healthcare needs.

Gold & Platinum plans: Best suited for complex medical conditions

If you have a chronic or serious medical condition, opting for a Gold or Platinum plan is advisable. Despite their higher monthly costs, these plans may result in overall savings if you require costly tests or treatments. This is because Gold and Platinum plans typically offer the lowest deductibles, coinsurance levels, and copays.

Silver plans: Best suited for average medical conditions

Silver plans present a favorable choice for the majority of individuals as they strike a balance between affordability and comprehensive coverage. Although they come at a higher cost compared to Bronze plans, Silver plans entail lower out-of-pocket expenses for doctor visits. Additionally, Silver plans feature moderate deductibles, coinsurance, and copays.

Bronze & Catastrophic plans: Best suited for few medical conditions

Consider choosing a Bronze or Catastrophic plan if you maintain overall good health and possess sufficient savings to cover a substantial portion of your healthcare expenses in the event of a severe illness or injury.

Medicaid: Best for low income

If you don’t earn much money, Medicaid might be a good choice for getting health insurance that’s either free or very cheap. Usually, Medicaid can lower or even remove the costs of healthcare.

It’s not as easy to get Medicaid in Florida compared to other places. To qualify, you usually need to be a parent or caregiver of a child, under 21 years old, or pregnant. Some people who were in foster care and are under 26 can also qualify. Additionally, if you’re elderly, blind, or disabled, you might be eligible. If you receive Supplemental Security Income (SSI), you’re automatically enrolled in Florida Medicaid.

Cheapest health insurance plan by Florida county

Health insurance costs change depending on your location. The Ambetter Standard Silver plan is the most affordable choice in Jacksonville, Tampa, and Orlando, as well as in many other parts of Florida. However, in Miami, the cheapest Silver plan is the Silver Classic offered by AmeriHealth Caritas Next.

Cheapest health insurance plan by Florida county

| County | Cheapest Silver plan | Monthly rate |

|---|---|---|

| Alachua | Ambetter Standard Silver | $536 |

| Baker | Ambetter Standard Silver | $521 |

| Bay | Ambetter Standard Silver | $478 |

| Bradford | Ambetter Standard Silver | $545 |

| Brevard | Health First Silver Value | $460 |

| Broward | Aetna Silver 5 | $470 |

| Calhoun | Ambetter Standard Silver | $461 |

| Charlotte | Aetna Silver 5 | $465 |

| Citrus | Ambetter Standard Silver | $482 |

| Clay | Molina Healthcare Silver 1 | $463 |

| Collier | Aetna Silver 5 | $541 |

| Columbia | Ambetter Standard Silver | $555 |

| De Soto | Ambetter Standard Silver | $570 |

| Dixie | Ambetter Standard Silver | $579 |

| Duval | Ambetter Standard Silver | $440 |

| Escambia | UHC Silver Standard | $505 |

| Flagler | Health First Silver Savings | $511 |

| Franklin | Ambetter Standard Silver | $489 |

| Gadsden | Ambetter Standard Silver | $503 |

| Gilchrist | Ambetter Standard Silver | $570 |

| Glades | Ambetter Standard Silver | $783 |

| Gulf | Ambetter Standard Silver | $496 |

| Hamilton | Ambetter Standard Silver | $841 |

| Hardee | Ambetter Standard Silver | $757 |

| Hendry | Aetna Silver 5 | $608 |

| Hernando | Ambetter Standard Silver | $483 |

| Highlands | Ambetter Standard Silver | $545 |

| Hillsborough | Ambetter Standard Silver | $465 |

| Holmes | Ambetter Standard Silver | $465 |

| Indian River | Ambetter Standard Silver | $463 |

| Jackson | Ambetter Standard Silver | $511 |

| Jefferson | Ambetter Standard Silver | $459 |

| Lafayette | Ambetter Standard Silver | $660 |

| Lake | Ambetter Standard Silver | $503 |

| Lee | UHC Silver Standard | $549 |

| Leon | Ambetter Standard Silver | $441 |

| Levy | Ambetter Standard Silver | $549 |

| Liberty | Ambetter Standard Silver | $487 |

| Madison | Ambetter Standard Silver | $472 |

| Manatee | Ambetter Standard Silver | $468 |

| Marion | Ambetter Standard Silver | $462 |

| Martin | Cigna Connect Silver 3000 | $512 |

| Miami-Dade | AmeriHealth Caritas Next Silver Classic | $490 |

| Monroe | Florida Blue BlueSelect Silver 1443 | $787 |

| Nassau | Ambetter Standard Silver | $566 |

| Okaloosa | Ambetter Standard Silver | $524 |

| Okeechobee | Ambetter Standard Silver | $538 |

| Orange | Ambetter Standard Silver | $502 |

| Osceola | Ambetter Standard Silver | $486 |

| Palm Beach | Oscar Silver Simple PCP Saver | $497 |

| Pasco | Ambetter Standard Silver | $498 |

| Pinellas | Ambetter Standard Silver | $467 |

| Polk | Ambetter Standard Silver | $519 |

| Putnam | Ambetter Standard Silver | $537 |

| St. Johns | Ambetter Standard Silver | $456 |

| St. Lucie | Aetna Silver 5 | $485 |

| Santa Rosa | UHC Silver Standard | $506 |

| Sarasota | Ambetter Standard Silver | $458 |

| Seminole | Health First Silver Savings | $506 |

| Sumter | Ambetter Standard Silver | $475 |

| Suwannee | Ambetter Standard Silver | $572 |

| Taylor | Capital Silver 2300 | $644 |

| Union | Ambetter Standard Silver | $817 |

| Volusia | Health First Silver Savings | $486 |

| Wakulla | Ambetter Standard Silver | $462 |

| Walton | Ambetter Standard Silver | $510 |

| Washington | Ambetter Standard Silver | $660 |

FAQ About Health Insurance in Florida

Is there free health insurance in Florida?

Yes, Medicaid provides free or low-cost health coverage to eligible needy persons.

How much a month is health insurance in Florida?

The lowest monthly premium for major medical plans begins at $177 for individuals, but the average monthly health insurance cost in Florida is around $467 per person.

Can you go to the hospital without insurance in Florida?

Yes, Hospitals must offer care to everyone, regardless of their ability to pay, as mandated by law. This rule extends to urgent care centers affiliated with hospitals. The cost of a typical emergency room visit can vary widely, from $623 in Maryland to $3,102 in Florida.

How do I get free medical care in Florida?

Shepherd’s Hope provides free healthcare for the uninsured.

Is Medicare free in Florida?

Medicare in Florida doesn’t come without cost, but there are potential avenues to assist with expenses such as copays and prescription costs.

FAQ About Health Insurance in Florida

Is there free health insurance in Florida?

Yes, Medicaid provides free or low-cost health coverage to eligible needy persons.

How much a month is health insurance in Florida?

In the realm of major medical plans, the least expensive monthly premium for individuals begins at $177, yet the average monthly health insurance expense in Florida hovers around $467 per person.

How do I get free medical care in Florida?

Shepherd’s Hope provides free healthcare for the uninsured.

What is the age limit for health insurance in Florida?

The Patient Protection and Affordable Care Act allows dependent children, whether married or unmarried, to remain covered under health plans until they reach the age of 26.

Are adults eligible for Medicaid in Florida?

As Florida has not expanded Medicaid, non-disabled adults under the age of 65 without dependents are ineligible for Medicaid in the state, regardless of their income level.