Best Health Insurance Companies & Plans in New York 2024

Fidelis Healthcare is often considered the top health insurance company in New York, especially if you qualify for Medicaid. However, it’s smart to check out other options too, as comparing quotes could help you save money.

Healthcare costs keep going up, making health insurance crucial. Even if you’re on a tight budget, finding affordable health insurance is now easier because of the Affordable Care Act. Let’s check out the top-rated, best health insurance companies in New York.

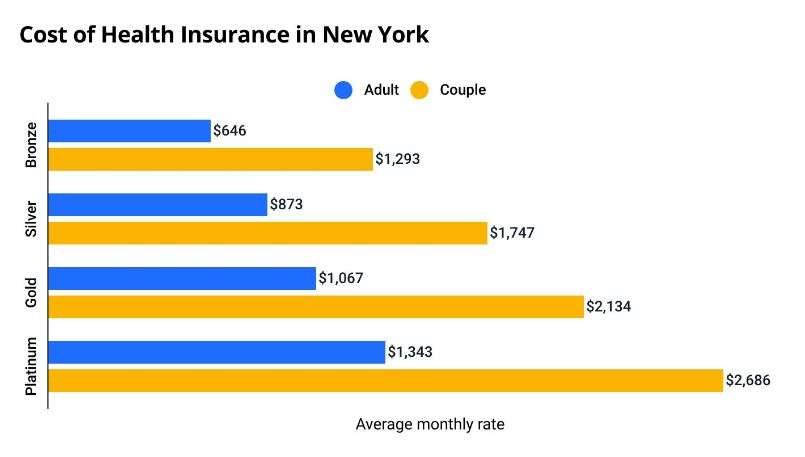

How much does health insurance cost in New York?

In New York, a Silver health insurance plan typically costs around $873 per month on average.

In New York, your age and whether you smoke doesn’t affect how much you pay for health insurance. Your rate is based on the plan you pick, how many people you’re insuring, and where you live in the state.

If you visit the doctor a lot, think about getting a Gold or Platinum plan. They cost more but cover more, so you’ll pay less for medical care. Bronze plans cost less each month but you pay more when you see the doctor.

Best Health Insurance in New York (NY)

- Best for Those Who Qualify for Both Medicare and Medicaid: Fidelis Healthcare

- Best for Low or $0 Premiums: Univera Healthcare

- Best Catastrophic Insurance Plan: Empire Blue Cross

- Same-Day Coverage Available: United Healthcare

Now that you know about health insurance, let’s see some of the best plans in New York with good prices. Do your research and click on each provider to find the cheapest health insurance in New York that gives you the most benefits.

Best for Medicare and Medicaid Qualified: Fidelis Care

Fidelis Care might provide a low-cost plan if you’re looking for affordable health insurance in New York & you qualify for both Medicare and Medicaid.

Fidelis Care’s Dual Advantage plan is great for those with disabilities or fixed incomes, offering seamless coverage between Medicare and Medicaid with minimal out-of-pocket expenses.

It provides some of the cheapest private plan choices in New York, making it a top pick for affordable health insurance in the state.

- Caters to Medicaid and low-income residents.

- A broad network of providers throughout New York.

- 24/7 telemedicine access.

- Mainly offer Bronze and Silver plans, with fewer Gold and Platinum options.

- Limited Online Resources.

- Potential Out-of-Network Costs.

Best for Low or $0 Premiums: Univera Healthcare

Univera Healthcare is another good choice for affordable health insurance in New York. It offers individual, family & Medicare / Medicare Advantage plans, making it the top affordable option for individuals and families in the state.

Univera Healthcare’s Essentials plan offers premiums as low as $0/month and provides extra deals on deductibles for low-income families.

Univera Healthcare provides coverage across New York State, ensuring accessibility with offices located near you. Additionally, all Univera plans include free preventive care such as vaccinations, check-ups, and screenings.

- Univera boasts a broad network of doctors and hospitals across New York state.

- A broad network of providers throughout New York.

- High customer satisfaction.

- Offer wellness programs and incentives

- Limited Medicare Advantage options.

- HMO-heavy focus.

- Limited online resources.

Best Catastrophic Insurance Plan: Empire BlueCross

If you’re young and healthy, consider a catastrophic plan to save money. Empire Blue Cross Blue Shield offers these plans, and you can easily check if you qualify and get a quote on their website.

Empire BlueCross is great for saving money and managing your healthcare independently. They provide lots of helpful information on preventive care and scheduling appointments.

Plans are accessible for as low as $49 per visit, offering basic health coverage options.

- Empire BlueCross offers a diverse range of plans across all metal tiers (Bronze, Silver, Gold, and Platinum),

- A broad network of providers throughout New York.

- Wider selection of Medicare Advantage plans.

- User-friendly online tools and resources

- Premiums can be higher.

- Limited Medicare Advantage options.

- Limited focus on preventive care.

- Restrictions on out-of-network care.

Same-Day Coverage Available: United Healthcare

United Healthcare could be your choice if you prefer large networks.

United Healthcare offers affordable plans with an extensive network, being one of the largest providers nationwide. They provide various plan options, including short-term gap coverage and Medicaid choices.

United Healthcare combines affordability with a broad network, making it a top choice for diverse health plans and more.

- Nationwide network reach.

- Competitive pricing options.

- Variety of plan designs to cater to different needs.

- Offers wellness resources and incentives.

- Customer satisfaction scores can vary.

- May not offer the most comprehensive coverage in all regions.

Average Cost of Health Insurance in NY

New York has high average health insurance costs compared to the national average. This is due to various factors, including a high cost of living, extensive regulations, and a high population density.

Costs vary significantly based on:

- Age: Premiums typically increase with age.

- Location: Urban areas generally have higher costs than rural areas.

- Plan type: Bronze plans have the lowest premiums but the highest out-of-pocket costs, while Platinum plans offer the widest coverage but the highest premiums.

- Network participation: In-network care is cheaper than out-of-network.

- Health status: Pre-existing conditions can affect premiums.

Here is a breakdown of some basic plans with their monthly premiums and deductibles:

| Plan Type | Estimated Monthly Premium | Deductible | Out-of-Pocket Maximum |

|---|---|---|---|

| Bronze (Individual, 40 years old) | ~$540 | ~$6,850 | ~$8,700 |

| Silver (Individual, 40 years old) | ~$820 | ~$4,700 | ~$7,350 |

| Gold (Individual, 40 years old) | ~$1,050 | ~$2,500 | ~$6,700 |

| Platinum (Individual, 40 years old) | ~$1,400 | ~$1,000 | ~$5,800 |

Factors to Consider When Choosing Health Insurance in NY

When choosing a health plan, there are factors beyond just the insurance rates to consider. You should take into account:

- Providers included in the plan: Does the plan cover your current healthcare providers? If not, it might be challenging to find alternative options for medical treatment.

- Medications Coverage: It’s important to ensure that the medications you require are included in the plan and to understand their costs. Some individuals encounter difficulties with insurance that doesn’t cover the medications they rely on daily.

- Free services: Before buying, be aware that many health insurance plans provide free support or services, so understand what you’re getting for free.

- Coinsurance: It’s the percentage you pay.

Finding Affordable Coverage For You

Before, finding health insurance meant comparing policies endlessly. ACA-compliant plans simplify this, but remember, it applies only to permanent health care plans, with group plans potentially differing.

Before opting for a low-cost short-term health plan, read its terms and conditions carefully. New Yorkers seeking cheap medical insurance can research with Benzinga anytime. Some listed companies also offer additional products like life insurance.

Cheapest health insurance plan by New York county

Fidelis Care offers the cheapest Silver plan in 49 out of New York’s 62 counties. In New York City, the most affordable health insurance is MetroPlus’ SilverPlus plan, averaging $805 per month.

The best plan for you depends on what you need. Compare all available plans in your area to find the best coverage for the best price.

Cheapest health insurance plan by New York county

| County | Cheapest Silver plan | Monthly rate |

|---|---|---|

| Albany | Fidelis Care Silver | $594 |

| Allegany | Fidelis Care Silver | $513 |

| Bronx | MetroPlus SilverPlus | $805 |

| Broome | Fidelis Care Silver | $590 |

| Cattaraugus | Fidelis Care Silver | $513 |

| Cayuga | Fidelis Care Silver | $590 |

| Chautauqua | Fidelis Care Silver | $513 |

| Chemung | Fidelis Care Silver | $590 |

| Chenango | Fidelis Care Silver | $560 |

| Clinton | Highmark Blue Shield Dep25 | $767 |

| Columbia | Fidelis Care Silver | $594 |

| Cortland | Fidelis Care Silver | $590 |

| Delaware | Fidelis Care Silver | $745 |

| Dutchess | Fidelis Care Silver | $745 |

| Erie | Fidelis Care Silver | $513 |

| Essex | Fidelis Care Silver | $560 |

| Franklin | Fidelis Care Silver | $560 |

| Fulton | Fidelis Care Silver | $594 |

| Genesee | Fidelis Care Silver | $513 |

| Greene | Fidelis Care Silver | $594 |

| Hamilton | Fidelis Care Silver | $560 |

| Herkimer | MVP Premier Plus Silver Dep25 | $773 |

| Jefferson | Fidelis Care Silver | $560 |

| Kings | MetroPlus SilverPlus | $805 |

| Lewis | Fidelis Care Silver | $560 |

| Livingston | Fidelis Care Silver | $601 |

| Madison | Fidelis Care Silver | $560 |

| Monroe | Fidelis Care Silver | $601 |

| Montgomery | MVP Premier Plus Silver Dep25 | $677 |

| Nassau | Healthfirst Silver Dep25 | $775 |

| New York | MetroPlus SilverPlus | $805 |

| Niagara | Fidelis Care Silver | $513 |

| Oneida | Fidelis Care Silver | $560 |

| Onondaga | Fidelis Care Silver | $590 |

| Ontario | Fidelis Care Silver | $601 |

| Orange | Fidelis Care Silver | $745 |

| Orleans | Fidelis Care Silver | $513 |

| Oswego | Fidelis Care Silver | $560 |

| Otsego | MVP Premier Plus Silver Dep25 | $773 |

| Putnam | Fidelis Care Silver | $745 |

| Queens | MetroPlus SilverPlus | $805 |

| Rensselaer | Fidelis Care Silver | $594 |

| Richmond | MetroPlus SilverPlus | $805 |

| Rockland | Fidelis Care Silver | $827 |

| Saratoga | Fidelis Care Silver | $594 |

| Schenectady | Fidelis Care Silver | $594 |

| Schoharie | MVP Premier Plus Silver Dep25 | $677 |

| Schuyler | Fidelis Care Silver | $590 |

| Seneca | Fidelis Care Silver | $601 |

| St. Lawrence | Fidelis Care Silver | $560 |

| Steuben | Fidelis Care Silver | $590 |

| Suffolk | Healthfirst Silver Dep25 | $775 |

| Sullivan | Fidelis Care Silver | $745 |

| Tioga | Fidelis Care Silver | $590 |

| Tompkins | Excellus BCBS Silver Standard Dep25 | $855 |

| Ulster | Fidelis Care Silver | $745 |

| Warren | Fidelis Care Silver | $594 |

| Washington | Fidelis Care Silver | $594 |

| Wayne | Fidelis Care Silver | $601 |

| Westchester | Fidelis Care Silver | $827 |

| Wyoming | Fidelis Care Silver | $513 |

| Yates | Fidelis Care Silver | $601 |

FAQs About Best Health Insurance for

FAQs About Best Health Insurance in NY

Is health insurance Free in New York?

Government health insurance programs are either free or offered at a low cost. These include Medicaid, Child Health Plus, and the Essential Plan.

Who is eligible for NY health insurance?

People who are not covered by employer-sponsored insurance or Medicare.

Is health insurance mandatory in NY?

The Affordable Care Act (ACA) mandates that nearly every individual and their dependents must have health insurance coverage.

Is Medicare free in NY?

If you have low income and resources, you might qualify for this coverage at minimal or no cost by applying for the Low Income Subsidy.

How much is health insurance in NY per month?

On average, a Silver plan in New York costs around $873 per month for health insurance.