Best Louisiana Health Insurance (2024 Plans)

Are you seeking the best health insurance options in Louisiana? Look no further. In this guide, we’ll explore the top health insurance providers in the state, their coverage options, and what sets them apart.

From affordable premiums to comprehensive coverage, we’ll help you navigate the landscape of health insurance in Louisiana so you can make an informed decision that meets your needs and budget.

Whether you’re an individual, a family, or a business owner, finding the right health insurance plan is crucial for your well-being. Let’s dive into the details and find the best health insurance in Louisiana.

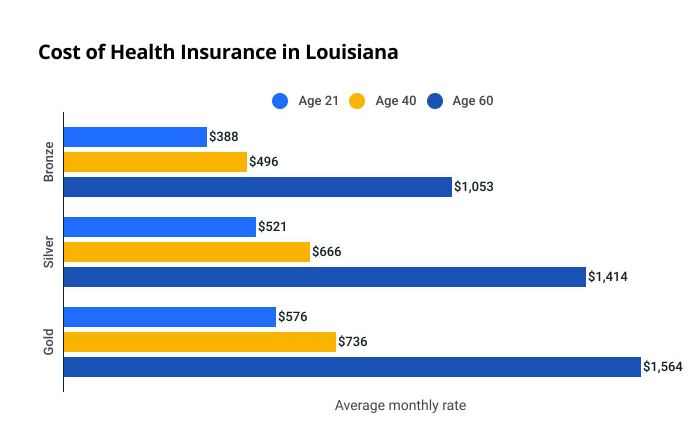

How much does health insurance cost in Louisiana?

The typical cost of health insurance in Louisiana is $666 per month for a 40-year-old purchasing a Silver plan.

Your age is one of the two main factors that influence the cost of health insurance.

In Louisiana, a 21-year-old typically pays around $521 per month for a Silver health insurance plan, which is 22% less than what a 40-year-old pays. However, after age 40, health insurance costs can rise rapidly. For instance, a 60-year-old with a Silver plan pays an average of $1,414 per month, which is more than double the cost for a 40-year-old.

Best Overall for Health Insurance in Louisiana

Ambetter offers top health insurance in Louisiana. Their plans feature competitive prices, minimal out-of-pocket expenses, and above-average claims handling.

For this, we examined 32 health insurance plans in Louisiana, including Silver EPO, HMO, POS, and PPO options.

Ambetter

Our top choice for the best health insurance in Louisiana is Ambetter. They provide eight Silver EPO plans with an average monthly rate of $541. The average maximum out-of-pocket cost for these plans is $7,725.

Ambetter’s Silver EPO plans have a structured network, which makes it easier to pick healthcare providers. You don’t need referrals to see specialists. These plans have an average monthly rate of $541 and an average maximum out-of-pocket cost of $7,725.

The denial rate of Ambetter is 15%, indicating they reject claims less often than many other insurers.

- Reasonable premiums

- Lower out-of-pocket costs

- Moderate claim denial rate

- Fewer plan-type availability

Plan Recommendations:

We recommend the following Silver plans:

- Clear Silver: $521/month

- Clear Silver + Vision + Adult Dental: $540/ month

- Focused Silver: $537/month

Best Health Insurance in Louisiana for Low Out-of-Pocket Costs

Ambetter offers the top health insurance in Louisiana for low out-of-pocket costs, scoring 82 out of 100 with MoneyGeek. Their plans have very competitive rates and keep out-of-pocket costs low.

It also has higher than average rates of approving claims, which means it doesn’t deny covering care as frequently as some other insurance companies might. To determine the best option, we examined various health insurance plans. We reviewed 11 Gold EPO plans, 3 Gold HMO plans, 9 Gold POS plans, and 2 Gold PPO plans from Louisiana.

Ambetter

Our top choice for the best health insurance in Louisiana for low out-of-pocket costs is Ambetter.

They provide eight Gold EPO plans, which have lower costs when you receive care within the plan’s network. These plans have an average monthly rate of $656 and an average maximum out-of-pocket cost of $7,325.

Ambetter’s denial rate is 14.84%, which is lower than many other insurers.

- Reasonable premiums

- Lower out-of-pocket costs

- Moderate claim denial rate

- Fewer plan-type availability

Plan Recommendations:

We recommend the below-mentioned Gold and Platinum plans:

- Elite Gold: $710/month; MOOP $5,500

- Everyday Gold: $615/month; MOOP $7,500

- Elite Gold + Vision + Adult Dental: $735/month; MOOP $5,500

Best Cheap Health Insurance in Louisiana

Ambetter is the top affordable health insurance provider in Louisiana. Their plans offer below-average rates, minimal out-of-pocket expenses, and fewer claim denials compared to most insurers.

We reviewed 32 Silver plans in Louisiana, consisting of 13 Silver EPO plans, 3 Silver HMO plans, 13 Silver POS plans, and 3 Silver PPO plans. We considered plans with lower monthly premiums more heavily, but it’s important to remember that typically, plans with lower premiums have higher out-of-pocket costs.

Ambetter

Our top choice for the best affordable health insurance in Louisiana is Ambetter. They offer eight Silver plans, providing families with a range of options for affordable healthcare coverage.

All of Ambetter’s Silver plans are EPO plans. These plans could be beneficial because they might have lower expenses when you visit doctors within the plan’s network.

They have an average monthly rate of $541 and an average maximum out-of-pocket cost of $7,725.

- very low denial of claims

- Low out-of-pocket maximum costs

- Favorably competitive premium rates

- More claim denials

Plan Recommendations:

We recommend the below-mentioned cheap Silver plans:

- Clear Silver: $521/month

- Clear Silver + Vision + Adult Dental: $540/month

- Standard Silver: $527/month

Best Health Insurance for Low Income in Louisiana

Ambetter offers the top health insurance in Louisiana for individuals with low income, earning a score of 90 out of 100. Their plans feature low premiums, minimal out-of-pocket costs, and fewer claim denials compared to most. In this assessment, we examined 13 Silver CSR EPO plans, 3 HMO plans, 13 POS plans, and 3 PPO plans in Louisiana.

We prioritized plans with low monthly premiums that offer cost-sharing reductions. These reductions decrease your healthcare expenses if you have a lower income. This allows you to save money each month without paying a lot when you require healthcare. Typically, a standard Silver plan covers around 70% of your healthcare costs, but with a CSR Silver plan, you may receive even more coverage.

- If you earn between $27,180 and $33,975 per year, you may have 73% of your health expenses covered.

- If your income is $20,385 to $27,180 annually, you can anticipate 87% of your expenses being covered.

- If you earn less than $20,385 per year, you can expect 94% of your expenses to be covered.

Ambetter

Our top choice for the best health insurance in Louisiana for individuals with low income is Ambetter. The company offers affordable plans for those earning below 250% of the Federal Poverty Level (FPL).

Ambetter provides eight Silver CSR plans, with an average monthly rate of $541 and an average maximum out-of-pocket (MOOP) cost of $6,438.

Ambetter doesn’t provide PPO or POS plans, but their EPO plans usually have cheaper monthly costs. However, they reject claims more often than other companies. Their best plan reduces out-of-pocket expenses for different income groups with the same premium.

- Low out-of-pocket maximum costs

- Favorably competitive premium rates.

- low denial of claims

Plan Recommendations:

Here are some low overall out-of-pocket costs based on income levels:

- 201-250% of the FPL: $521/month

- 151-200% of the FPL: $521/month

- Up to 150% of the FPL: $521/month

Best Health Insurance for Young Adults in Louisiana

Ambetter offers the top health insurance for young adults in Louisiana. They have lower out-of-pocket expenses and reject claims less frequently than other insurers. Catastrophic plans are available only for young adults under 30, typically costing less monthly but possibly requiring higher payments for care when needed.

In Louisiana, we examined a total of 1 Bronze EPO plan, 1 Bronze POS plan, 2 Bronze PPO plans, 9 Expanded Bronze EPO plans, 3 Expanded Bronze HMO plans, 8 Expanded Bronze POS plans, and 2 Expanded Bronze PPO plans.

Ambetter

Ambetter is our top choice for the best health insurance in Louisiana for young adults. Since young adults typically require fewer medical services, they often opt for lower coverage levels.

Ambetter offers one Catastrophic plan and six Expanded Bronze plans. These plans have an average monthly rate of $400, with an average maximum out-of-pocket cost of $9,300.

Ambetter doesn’t have PPO or POS plans, but their EPO plans can be beneficial. EPO plans usually have lower premiums, and selecting providers within the network can improve care coordination.

- Competitive premium rates.

- Low out-of-pocket maximum costs

- Variety of plan types

Plan Recommendations:

We recommend the following plans for young adults:

- Everyday Bronze:

- $334/month for 18 year olds

- $375/month for 26 year olds

- Everyday Bronze + Vision + Adult Dental:

- $346/month for 18 year olds

- $388/month for 26 year olds

- Elite Bronze:

- $389/month for 18 year olds

- $436/month for 26 year olds

Best Health Insurance by Plan Type in Louisiana

Health insurance companies offer various plans for you to choose from. The top providers for all plan categories in Louisiana are:

- EPO: Ambetter

- POS: Blue Cross Blue Shield

- PPO: Blue Cross Blue Shield

- HMO: Christus Health

Our recommendations focus solely on Silver plans. These plans are suitable for individuals who occasionally visit the doctor. They help strike a balance between your monthly payments and the expenses incurred when seeking medical care.

Louisiana offers various Silver plans to choose from, including 13 Silver EPO plans, 3 Silver HMO plans, 13 Silver POS plans, and 3 Silver PPO plans.

PPO: Blue Cross Blue Shield

Our top choice for the best health insurance in Louisiana for Silver PPO plans is Blue Cross Blue Shield. They provide three Silver PPO plans with an average monthly rate of $775 and an average maximum out-of-pocket cost of $8,850. The company has a denial rate of 17.4%, indicating they reject fewer claims than average.

PPO plans offer more options for doctors and hospitals, and you don’t need a referral to see a specialist. They’re popular but can be more expensive than other plans. If you’re willing to pay extra, they give you more flexibility in choosing your healthcare.

Plan Recommendations:

We recommend the following Silver PPO plans from Blue Cross Blue Shield:

- Blue Saver 90/70 $3400: $769/month

- Blue Max Copay 60/40 $5900 Standardized Plan: $778/month

EPO: Ambetter

Our top choice for the best health insurance in Louisiana for Silver EPO plans is Ambetter. They have eight different Silver EPO plans available. The average monthly rate for these plans is $541, and the average maximum out-of-pocket cost is $7,725. Ambetter’s denial rate is 14.84%, which is lower than most other providers.

Silver EPO plans have their pros and cons. They’re popular, ranking as the third most chosen plan type. One advantage is you don’t usually need approval to see specialists, unlike some other plans. However, you must stick to doctors within the plan’s network, except in emergencies. This limitation means you might not always have the freedom to choose any doctor you prefer.

Plan Recommendations:

We recommend the following Silver EPO plans from Ambetter:

- Clear Silver is around $521/month

- Clear Silver + Vision + Adult Dental around $540/month

PPO: Blue Cross Blue Shield

Our top choice for the best health insurance in Louisiana among Silver POS plans is Blue Cross Blue Shield. They provide 13 plans with an average monthly rate of $631 and an average maximum out-of-pocket cost of $8,684. Blue Cross Blue Shield has a denial rate of 17.38%, indicating they reject fewer claims than average.

Silver POS plans provide both in-network and out-of-network coverage, with higher costs for out-of-network care. They offer flexibility to choose any provider while maintaining lower costs for in-network services. While less common, they offer a middle ground between flexibility and cost.

Plan Recommendations:

We recommend the following Silver POS plans from Blue Cross Blue Shield:

- Blue Connect 80/60 $3400 (S): $504/month

- Signature Blue 80/60 $3400: $519/month

HMO: Christus Health

Our top choice for the best health insurance in Louisiana among Silver HMO plans is Christus Health. They provide an average plan rate of $561 with an average maximum out-of-pocket cost of $9,017. The provider has a denial rate of 6.92%, which is lower than average.

Silver HMO plans are affordable and popular, but you must stick to the network for non-emergency care. You’ll need a referral to see a specialist. These plans are ideal if you want lower monthly costs and access to nearby in-network doctors.

Plan Recommendations:

We recommend the following Silver HMO plans from Christus Health:

- CHRISTUS Silver: $564/month

- CHRISTUS Standard Silver: $549/month

How to Find the Best Health Insurance for You in Louisiana

Your budget and healthcare needs will help you choose the right health insurance provider in Louisiana. Consider how much you can afford monthly and your expected medical expenses. Here are some tips to help you plan for health insurance:

Understand when a health insurance plan will cover you

In health insurance, if you visit doctors and hospitals in your plan’s network, you’ll pay less. Going outside the network could mean paying more or not being covered at all. Some plans offer more flexibility to see doctors outside the network, but they might cost more. Choose the option that suits your budget and whether you want more choices in doctors.

In Louisiana, there are 13 EPO plans and 3 PPO plans. EPO plans prioritize network doctors and usually have lower costs. PPO plans offer more flexibility to see doctors outside the network but might have slightly higher costs.

Weigh the cost of premiums vs. the cost of care

Choosing the right health insurance plan involves balancing your monthly payments with the amount you might need to pay for doctor visits and medications. Some plans have lower monthly costs but require higher payments if you need frequent medical care. On the other hand, if you’re willing to pay more each month, you might not have to cover as much of the costs yourself.

One example is Ambetter’s Clear Silver plan, which has the lowest out-of-pocket costs at $5,400. This plan’s monthly premium is $521, which is lower compared to other Silver plans offered by Ambetter. If the plan’s network of doctors and services meets your needs, this could be an excellent option because it offers reasonable monthly payments while providing protection against large medical expenses.

Consider Louisiana Medicare or Medicaid if You’re Eligible

If you’re 65 or older or have a qualifying illness or disability, you can consider Medicare. It’s a federal health insurance program that provides financial help for healthcare services. Medicare has different parts:

- Part A (Hospital Insurance): Covers hospital stays, skilled nursing facilities, hospice care, lab tests, and surgeries.

- Part B (Medical Insurance): Covers doctor visits, home health care, preventive services, and durable medical equipment for outpatient care.

- Part D (Prescription drug coverage): Pays the prescribed medication cost.

Besides Medicare, there’s another government program called Medicaid to assist low-income individuals with coverage. If your income is below 133% of the Federal Poverty Level (FPL) for your household size, you might qualify for Medicaid.

FAQ About Louisiana Health Insurance

How much is health insurance in Louisiana per month?

A 21-year-old in Louisiana pays $521/month for Silver health insurance, 22% less than a 40-year-old.

What is the purpose of the Louisiana Life and health insurance?

The Louisiana Life and Health Insurance Guaranty Association covers claims under certain policies if the insurer goes bankrupt.

Does Louisiana have Medicare?

Yes, More than 913,000 citizens are registered in Medicare in Louisiana.

How to apply for health insurance in Louisiana?

You can sign up for a Louisiana health insurance Marketplace plan either through HealthCare.gov, the ACA exchange website, or by calling (800) 318-2596 (TTY: 1-855-889-4325).

Who is eligible for Medicare in Louisiana?

In general, Medicare is for individuals who are 65 years old or older.