When it comes to securing your health and well-being in Nevada, finding the best health insurance is crucial. With the diverse range of options available, navigating Nevada’s health insurance landscape can be challenging.

From understanding what constitutes the best health insurance in Nevada to exploring the specifics of Las Vegas health insurance, it’s essential to delve into factors such as coverage, affordability, and accessibility. Additionally, prospective policyholders often inquire about the average cost of health insurance in Nevada per month.

This comprehensive guide aims to shed light on these aspects, ensuring you make informed decisions about your healthcare coverage in the Silver State.

How much is health insurance in Nevada?

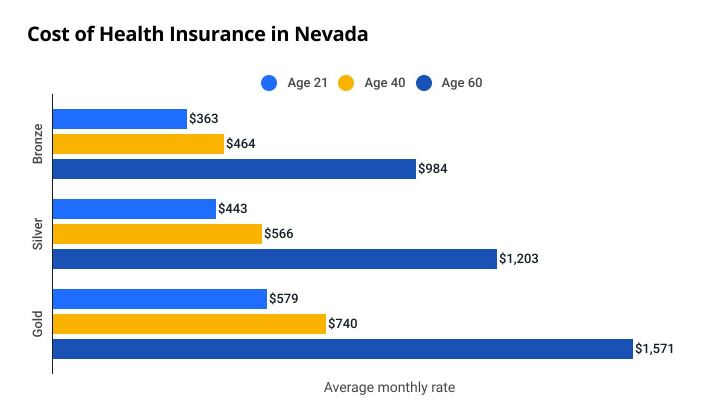

How much is health insurance in Nevada per month varies depending on several factors, including:

- Your age: Premiums typically increase with age.

- Your location: Costs can differ based on your county or zip code.

- Your health: People with pre-existing conditions may pay more.

- The type of plan you choose: Different metal tiers (Bronze, Silver, Gold, Platinum) offer varying coverage levels and costs.

- Whether you qualify for subsidies: Financial assistance can significantly lower your monthly premium.

Here’s the latest information:

- Individual plans:

- Silver plan (most popular): $566 per month (average for a 40-year-old)

- Bronze plan (cheapest): $297 per month (average)

- Gold Plan: $478 per month (average)

- Family plans: Costs vary greatly depending on family size and composition.

Cheapest options:

- Individual plans:

- Bronze plan: Anthem ($297 per month)

- Silver plan: Health Plan of Nevada ($357 per month)

- Gold plan: Ambetter ($478 per month)

What is the Best Health Insurance in Nevada?

Determining the best health insurance in Nevada involves evaluating several key factors tailored to your specific needs.

Firstly, consider the scope of coverage offered by different insurance plans. Look for policies that provide comprehensive coverage for medical services, prescription drugs, preventive care, and specialist consultations.

Additionally, assess the network of healthcare providers included in each plan, ensuring access to reputable hospitals, clinics, and physicians in your area. Moreover, consider factors such as deductible amounts, copayments, and coinsurance rates to gauge each insurance option’s overall affordability and value.

By weighing these factors against your individual healthcare needs and budget, you can identify the best health insurance plan tailored to your requirements in Nevada.

Overall Best Health Insurance in Nevada

Ambetter from SilverSummit offers the top health insurance in Nevada. It’s known for having the lowest out-of-pocket costs in the state. This provider handles plan claims better than most and offers affordable plans in Nevada. We studied 52 silver plans in Nevada, including one Silver EPO plan and 51 Silver HMO plans, for our analysis.

Ambetter from SilverSummit

Our top choice for the best health insurance in Nevada is Ambetter from SilverSummit. They provide 11 Silver HMO plans with an average monthly rate of $515 and an average maximum out-of-pocket cost (MOOP) of $7,479.

Ambetter from SilverSummit offers Silver HMO plans for individuals who prefer a network-based healthcare approach. These plans usually mandate members to receive care from providers within their network.

Additionally, the provider boasts a denial rate of 0.15%, which is lower than that of most competitors.

- Lower out-of-pocket costs

- Rare claims denied

- Higher premium rates

- Fewer plan types

Plan Recommendations:

We recommend the following Silver plans:

- Clear VALUE Silver: $400/month

- Clear Silver: $506/month

- Clear Silver + Vision + Adult Dental: $532/month

Best Health Insurance in Nevada for Low Out-of-Pocket Costs

Imperial Insurance Companies, Inc. provides the best health insurance in Nevada for low out-of-pocket costs. Their plans are cheaper compared to other options, and they are better at approving claims.

For this research, we examined 21 Gold plans in Nevada.

Imperial Insurance Companies, Inc.

We recommend Imperial Insurance Companies, Inc. as the best choice for health insurance in Nevada if you want to keep your out-of-pocket costs low. They offer two Gold plans, which are known for having lower out-of-pocket expenses.

Imperial Insurance provides health plans with an average monthly cost of $586 and an average maximum out-of-pocket cost of $8,350. They have a denial rate of 0%, which means they reject fewer claims compared to other companies.

- Rare claims denied

- Competitive MOOP costs

- Average premiums

- Limited plan types

Plan Recommendations:

We recommend the following Silver plans:

- Imperial Preferred Gold: $596/month

- Imperial Standard Gold: $575/month

Best Cheap Health Insurance in Nevada

SelectHealth, Inc. is the leading choice for affordable health insurance in Nevada. They offer the cheapest plan options and approve more claims compared to other providers.

We looked at 52 Silver plans in Nevada for this study, which included one Silver EPO plan and 51 Silver HMO plans. MoneyGeek focused more on plans with low monthly premiums, even though they might lead to higher out-of-pocket costs.

SelectHealth

We recommend SelectHealth, Inc. as the top choice for affordable health insurance in Nevada. They provide five Silver plans, with an average monthly cost of $403 and an average maximum out-of-pocket cost of $8,550. SelectHealth also has a denial rate of 15%, which is better than many other options.

SelectHealth offers HMO Silver plans. With HMO plans, members typically need to use healthcare providers within the network.

- Offers reasonable premium rates.

- Rare claims denied

- Fixed plan options

- Elevated maximum out-of-pocket expenses

- Higher claim denials

Plan Recommendations:

We recommend the following cheap Silver plans:

- Select Health Med Silver 6500 – no referrals: $394/month

- Select Health Value Silver 6500 – no deductible: $398/month

- Select Health Med Silver Copay Plan: $408/month

Best Health Insurance for Young Adults in Nevada

SelectHealth, Inc. provides the top health insurance option in Nevada for young adults. Their plans have good prices and lower-than-average out-of-pocket costs. Plus, they reject claims less often than other companies

We looked at 37 Bronze plans and four Catastrophic plans for this group. Only people who are under 30 years old can enroll in Catastrophic coverage.

SelectHealth, Inc

We suggest SelectHealth, Inc. as the best health insurance option in Nevada for young adults. Young adults typically opt for less coverage since they visit the doctor less often than older individuals. SelectHealth, Inc. offers six Expanded Bronze plans and no Catastrophic plans. These plans cost around $270 per month on average, with a maximum yearly out-of-pocket expense of $8,833.

In Nevada, SelectHealth, Inc. doesn’t provide PPO or POS plans. However, their HMO plans let you see doctors within a network without requiring a referral. Compared to other companies, SelectHealth has a denial rate of around 15%, which is lower.

- Offers reasonable premium rates.

- Rare claims denied

- Only offers HMO plans

Plan Recommendations:

We recommend the following plans for young adults:

- Select Health Med Exp Bronze 8000 HSA Qualified:

- $248/month for 18 year olds

- $278/month for 26 year olds

- Select Health Value Exp Bronze 8000 HSA Qualified:

- $250/month for 18 year olds

- $280/month for 26 year olds

- Select Health Med Exp Bronze 9400 – no referral required:

- $244/month for 18 year olds

- $274/month for 26 year olds

Best Health Insurance in Nevada by Plan Type

Health insurance companies provide various types of plans. The top providers for all plan categories in Nevada are:

- EPO: Anthem Health

- HMO: Ambetter from SilverSummit

We only looked at Silver plans for its suggestions. Silver plans usually strike a balance between monthly premiums and what you spend when you use healthcare services. They’re good for people who don’t often need to see the doctor or get prescriptions.

In Nevada, there is one Silver EPO plan and 51 Silver HMO plans available.

EPO: Anthem Health

We suggest Anthem Health as the top choice for Silver EPO plans in Nevada. They have an average monthly cost of $520 and an average maximum out-of-pocket expense of $7,600. However, Anthem Health has a denial rate that is higher than average, around 23%.

Silver EPO plans are like HMO plans because you have to stick with the doctors and hospitals in the plan’s network, except in emergencies. But usually, you don’t need a referral to see a specialist.

Plan Recommendations:

We recommend the following Silver EPO plan from Anthem Health:

- Anthem Silver X EPO 5500 $0 Virtual PCP $0 Select Rx: $520/month

HMO: Ambetter from SilverSummit

Our top choice for the best health insurance in Nevada for Silver HMO plans is Ambetter from SilverSummit. They have an average monthly cost of $515 and an average maximum out-of-pocket expense of $7,479. Additionally, the company has a denial rate of nearly 0%, meaning it rejects fewer claims than usual.

Silver HMO plans usually cost less each month, which is good for those who prefer lower payments and have doctors within the HMO network. However, you must stick to network doctors, and if you need to see a specialist, you’ll need a referral.

Plan Recommendations:

We recommend the following Silver HMO plans from Ambetter from SilverSummit:

- Clear VALUE Silver: $400/month

- Clear Silver: $506/month

Las Vegas Health Insurance:

As the largest city in Nevada, Las Vegas offers a plethora of health insurance options to its residents.

Whether you’re seeking coverage for routine check-ups, emergency care, or specialized treatments, Las Vegas health insurance plans cater to diverse healthcare needs. Residents can explore a range of private insurance options through reputable insurers, as well as government-sponsored programs such as Medicaid and CHIP (Children’s Health Insurance Program).

Additionally, Nevada Health Link serves as a valuable resource for Las Vegas residents looking to compare and purchase health insurance plans online.

With a focus on affordability, accessibility, and comprehensive coverage, Las Vegas health insurance options ensure residents can safeguard their health and well-being effectively.

How to Find the Best Health Insurance for You in Nevada

The best private health insurance in Nevada depends on your budget and medical needs. A good provider will offer coverage that fits your needs at prices you can afford.

Here are two important things to think about when choosing the right insurer for your health insurance plan.

Understand when a health insurance plan will cover you

In-network coverage means your health insurance covers more of the cost when you visit doctors within the plan’s network. Out-of-network coverage is when you visit doctors who are not in the plan’s network, and the insurance might not cover as much of the cost.

In Nevada, there is one EPO plan and 51 HMO plans available. Some plans allow you to visit any doctor, but they are more expensive. Other plans are cheaper but require you to see doctors within the network.

Weigh the cost of premiums vs. the cost of care

Selecting the correct health insurance is about finding a balance. Consider both your monthly payments and the maximum amount you might have to pay out of pocket, depending on your needs. Lower monthly payments usually result in higher costs later if you require frequent care. Conversely, paying more each month might lead to a lower maximum out-of-pocket expense, potentially saving you money if you visit the doctor often.

The Silver plan named Clear VALUE Silver has a maximum out-of-pocket cost of $5,400. Its monthly rate is $400, which is lower than other Silver plans offered by the same company. A plan with both low monthly payments and a low maximum out-of-pocket cost is ideal, especially if the services provided are of good quality.

Consider Nevada Medicare or Medicaid if You’re Eligible

If you’re 65 or older or have a qualifying illness or disability, you can consider Medicare. It’s a federal health insurance program that provides financial help for healthcare services. Medicare has different parts:

- Part A (Hospital Insurance): Covers hospital stays, skilled nursing facilities, hospice care, lab tests, and surgeries.

- Part B (Medical Insurance): Covers doctor visits, home health care, preventive services, and durable medical equipment for outpatient care.

- Part D (Prescription drug coverage): Pays the prescribed medication cost.

If Medicare doesn’t cover all your health needs, you might need to think about getting private health insurance. To find out what’s best for you, you can check our suggestions for the top Medicare Advantage and Medicare Supplement plans in Nevada.

Because Nevada expanded Medicaid, you can also enroll in Medicaid for free. This program is another government health insurance option you might qualify for if your income is below 138% of the Federal Poverty Level.

Conclusion

Finding the best health insurance in Nevada requires careful consideration of factors such as coverage, affordability, and accessibility. By leveraging resources such as Nevada Health Link and understanding the specifics of Las Vegas health insurance options, residents can navigate the state’s healthcare landscape with confidence.

Additionally, exploring the average cost of health insurance in Nevada per month and potential financial assistance programs can help mitigate expenses while ensuring adequate coverage. Finally, prioritizing your health and well-being through informed decision-making empowers you to secure reliable health insurance coverage tailored to your needs in the Silver State.

FAQ About Health Insurance in Nevada

What is the average cost for health insurance in Nevada?

The typical cost of health insurance in Nevada is $5,964 per person, according to the latest published data.

Does Nevada have free health insurance?

The Nevada Department of Health and Human Services provides Medicaid help through various programs for individuals and families. Some services is free, while some may require a fee.

Does Nevada have Medicare?

Yes.

What age is Medicare in Nevada?

Medicare is health insurance for individuals aged 65 or older.

How many people are on Medicare in Nevada?

There are 652,000 Medicare beneficiaries in Nevada.