Best Health Insurance in Alabama

Finding the best and most affordable health insurance options in Alabama can be overwhelming. With so many providers, deciding the best health insurance in Alabama is hard. But fear not, fellow Alabamans! We’ve compiled a comprehensive guide to help you find the perfect plan to meet your healthcare needs and budget.

This comprehensive guide will help you understand these issues and make an informed decision about your health coverage in the Heart of Dixie.

How much does health insurance cost in Alabama?

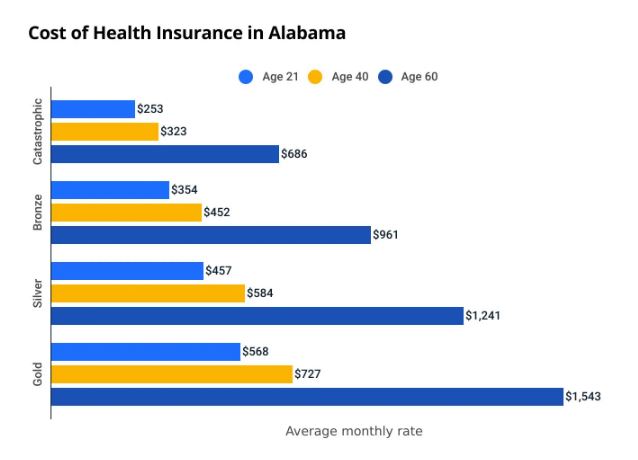

In Alabama, a Silver plan costs an average of $584 per person monthly. As you get older, your rate will increase. In Alabama, a 60-year-old pays more than twice as much for health insurance as a 40-year-old.

Best Health Insurance in Alabama

Blue Cross Blue Shield is the best provider of health insurance in Alabama. Our evaluation of health insurance companies for 2024 considered age, maximum out of pocket (MOOP) cost, plan flexibility, and claim manage.

Below, you’ll find Alabama most cost-effective health insurance plans from each metal tier:

| Tier | Plan | Monthly Cost | Notes |

|---|---|---|---|

| Bronze | UnitedHealthcare Bronze Essential | $379 | Basic coverage, high deductible. Good for generally healthy individuals. |

| Silver | Ambetter Standard Silver | $496 | Moderate coverage, moderate deductible. Good for those who use healthcare occasionally. May qualify for cost-sharing reductions. |

| Gold | UnitedHealthcare Gold Value | $583 | High coverage, low deductible. Good for those with chronic conditions or who expect high medical costs. |

| Catastrophic | BCBS Blue Protect | $303 | Limited coverage, very high deductible. Only for individuals under 30 who meet certain income requirements. |

Overall Best Health Insurance in Alabama

Blue Cross Blue Shield is the best insurance provider in Alabama. Blue Cross Blue Shield is known for offering affordable health plans that reduce out-of pocket costs. This provider manages claims efficiently and denies them very rarely.

The best health insurance plans in Alabama were determined by analyzing data from 15 Silver Exclusive Provider Organizations (EPO) and five Preferred Provider Organizations (PPO).

Blue Cross Blue Shield

Blue Cross Blue Shield is our pick for the best health insurance provider in Alabama. The provider offers two Silver EPO plans, five Silver PPO Plans, and an average monthly plan cost of $501 for the Silver EPO Plans. The average MOOP for these plans comes to $8,463.

BCBS’s Silver PPO plans come with the added benefit of more out-of-network coverage. This provider’s EPO plans are also recommended due to their uncomplicated structure, as they do not require specialist referrals. BCBS has a denial rate score of 17%, lower than much of the competition.

Plan Recommendations:

We recommends the below mentioned Silver plans from Blue Cross Blue Shield:

- Blue HSA Silver for Business: $352/month

- Blue Secure Silver for Business: $382/month

- Blue Standardized Silver: $584/month

Best Health Insurance in Alabama for Low Out-of-Pocket Costs

Blue Cross Blue Shield (BCBS) is the top medical insurance service in Alabama for cost-effective out-of-pocket expenses. BCBS is a top performer in a variety of crucial areas. The company offers a range of plans that are affordable as well as low out-of pocket costs as well as being less prone refuse claims as compared to the other companies in Alabama.

To conduct this analysis we analyzed 13 plans which included Six Gold EPO plans Six Gold PPO plans, and One Platinum PPO program.

Blue Cross Blue Shield

Our top choice for the most affordable health insurance coverage in Alabama for lower out-of-pocket costs includes Blue Cross Blue Shield. Blue Cross Blue Shield has the following plans: six Gold PPO plans as well as a Platinum PPO plan. These are the metal levels that are renowned for their lower MOOP prices. The plans offer an average monthly cost for a month of 534 dollars, and the average MOOP cost is $6,089.

PPO plans usually provide greater outside-of-network coverage. This means that BCBS offers customers more hospitals and doctors to pick from. BCBS also has a denial rate of just 17 percent, which is lower than the majority of competitors, which means you’re likely to get your claim.

Plan Recommendations:

We recommends the below mentioned Silver plans from Blue Cross Blue Shield:

- Blue Choice Platinum for Business: $559/month

- Blue Access Gold for Business: $494/month

- Blue Secure Gold for Business: $462/month

Best Cheap Health Insurance in Alabama

Blue Cross Blue Shield is the highest-rated affordable healthcare insurance company in Alabama. BCBS provides more affordable plans with lower costs for out-of-pocket expenses and also denies claims less than most other companies.

In this section, we evaluated 20 Silver plans in Alabama. It includes 15 silver EPO plans and five PPO plans in Silver. While we targeted plans with lower monthly costs, remember that those with higher premiums usually include higher out-of-pocket expenses.

Blue Cross Blue Shield

Blue Cross Blue Shield is our top pick for the best cheap health insurance in Alabama. It offers seven different Silver plans, giving consumers several budget-friendly options for their health care. These Silver BCBS plans average $434 monthly, with an $8,137 average maximum out-of-pocket cost.

Both PPO and EPO types are available among the Silver plans BCBS offers. Its five PPO plans tend to offer more out-of-network coverage, whereas its two EPO plans may offer lower out-of-pocket costs when you stay within the network.

BCBS has a denial rate of 17%, much lower than the highest denial rate in our analysis (35%). This is good for customers looking to receive reliable coverage.

Plan Recommendations:

We recommends the below mentioned cheap Silver plans:

- Blue HSA Silver for Business: $352/month

- Blue Secure Silver for Business: $382/month

- Blue Saver Silver EPO: $569/month

Best Health Insurance for Low Income in Alabama

UnitedHealthcare offers the most affordable health insurance plan in Alabama for people with a low income. UnitedHealthcare highlights include low-cost plan choices with lower-than-average rates. However, the company has significantly higher costs for out-of-pocket expenses and a higher proportion of claims that are denied compared to other providers.

For this group, we looked at Silver plans that offer eligible Cost-sharing cuts (CSRs). In Alabama, we analyzed 18 plans that qualify for CSRs, which included 15 EPOs as well as three PPOs.

To provide the most suitable option for those who earn a small amount and have a low income, we weighed the Silver CSR plans based on low monthly costs, which can help you save money on rates and costly out-of-pocket expenditures. A typical Silver plan covers about 70% of health-related expenses. However, Silver plans with CSRs provide various percentages, dependent on income.

- Earnings of between $27,180 and $33,975 annually (201-250 percent of FPL) Estimate 73 percent of the health insurance costs paid.

- Earnings are between $20,385 and $27.180 annually (151-200 percent of FPL). The average is 87% of the costs to be paid.

- Earnings below $20,385 annually (up to 150 percent of FPL) You can expect 94% of your expenses to be paid.

Be aware that the income brackets are based on the amount of people in the household.

UnitedHealthcare

UnitedHealthcare is the best health insurance option for those living in Alabama with a low income. It provides cost-effective plans to people earning less than 250 percent below the poverty threshold (FPL).

UnitedHealthcare provides 5 Silver CSR plans for Alabama people who meet the eligibility requirements at a monthly cost of $577. The MOOP average for these plans is $7310.

Although the provider offers EPO plans, These plans typically come with lower costs than PPO and POS plans. The rate of denial in the case of UnitedHealthcare is 32 percent. This indicates that the company denies claims more often than its competitors.

Plan Recommendations:

UnitedHealthcare’s top-rated plan offers lower out-of-pocket expenses for the same premium for people in different income brackets. Here are some of the lower overall out-of-pocket costs based on income levels:

- 201–250% of the FPL: $572/month

- 151–200% of the FPL: $572/month

- Up to 150% of the FPL: $572/month

Best Health Insurance for Young Adults in Alabama

Blue Cross Blue Shield tops the list of the top health insurance plans in Alabama. Blue Cross Blue Shield offers an affordable, low-cost plan with less-than-average out-of-pocket expenses. The denial rate for claims is superior to the norm.

In our analysis, we analyzed only one Bronze EPO plan, twelve Expanded Bronze EPO plans, four Expanded Bronze Plans for PPO, and one Catastrophic PPO program.

Blue Cross Blue Shield

Blue Cross Blue Shield is the most popular choice for young people seeking healthcare insurance in Alabama. Young people usually choose less coverage since they usually receive fewer medical treatments than older people. The insurance company provides the following plans: four Expanded Bronze plans and one Catastrophic plan. One will cost around $242 monthly and an out-of-pocket maximum of $8,538 for the year.

BCBS provides Catastrophic as well as Expanded Bronze plans as PPOs. PPO plans are renowned for their flexibility and include the ability to cover out-of-network services. BCBS’s denial percentage BCBS is approximately 17% lower than most other plans. This means that it’s more likely to take any insurance-related claim.

Plan Recommendations:

We recommends the below mentioned BCBS plans for young adults in Alabama:

- Blue HSA Bronze

- $223/month for 18 year olds

- $360/month for 26 year olds

- Blue Protect

- $162/month for 18 year olds

- $261/month for 26 year olds

- Blue Saver Bronze for Business

- $206/month for 18 year olds

- $231/month for 26 year olds

Best Health Insurance by Plan Type in Alabama

Health insurance companies provide various plan options. You can choose from 15 silver EPO plans, and five Silver PPO plans in Alabama. The top service providers for all plans that are available in Alabama are:

- EPO: Ambetter

- PPO: Blue Cross Blue Shield

Our analysis only included Silver plans as part of these suggestions. Silver plans are great for those who regularly require health care services as they can balance the cost you pay each month with the charges you incur for medical services. Essentially, they provide an excellent balance of affordability for premiums and out-of-pocket expenses.

PPO: Blue Cross Blue Shield

Our top choice for most affordable health insurance in Alabama for plans with Silver PPO includes Blue Cross Blue Shield. Blue Cross Blue Shield has 5 Silver PPO options with an average rate of $432 a month and an annual MOOP of $8,127. With an average denial rate of 17 percent, it’s less than other insurance companies.

PPO plans can provide greater freedom for policyholders to select their preferred providers. They don’t require referrals to specialists. They’re readily available, being the most frequent option in Alabama. However, they can be more expensive than HMO plans and may not be the most appropriate option if you try to stay within your budget.

Plan Recommendations:

We recommends the below mentioned Silver PPO plans from Blue Cross Blue Shield:

- Blue HSA Silver for Business: $352/month

- Blue Secure Silver for Business: $382/month

EPO: Ambetter

Our top advice for the top health insurance plan in Alabama that offers silver EPO Plans is Ambetter, which offers eight plans with an average cost of $614 per month and $7,725 in MOOP. With an approval rate of only 15 percent, Ambetter is better than many health insurance providers in approving claims.

Silver EPO plans offer distinct advantages and drawbacks. They’re the third most frequent type of plan, and you don’t need the assistance of specialists. But, as with HMOs, they require you to remain within the network in the event of an emergency, which can be restrictive.

Plan Recommendations:

We recommends the below mentioned Silver EPO plans from Ambetter:

- Clear Silver: $597/month

- Clear Silver + Vision + Adult Dental: $618/month

How to Find Best Health Insurance in Alabama for you

Your budget and medical needs, which include how much you’re prepared to pay each month and how often you’ll need medical treatment, decide which health insurance company in Alabama is best for you. These tips can prove helpful in planning your health insurance.

Understand when a health insurance plan will cover you

Health insurance can have different rules about where you can get care. “In-network” means doctors and hospitals have a deal with your insurance to charge less. “Out-of-network” doesn’t have this deal, so they can charge more. Some plans let you see any doctor, while others only cover visits to specific doctors.

In Alabama, there are five PPO plans and fifteen EPO plans. PPO plans to provide more flexibility by paying for some outside-network healthcare. However, they are costly. EPO plans are less expensive but generally won’t cover out-of-network services unless there’s an emergency. The trade-offs you make are crucial to consider when selecting health insurance.

Weigh the cost of premiums vs. the cost of care

When choosing health insurance, consider a plan that fits your needs. Think about your monthly payments and potential yearly medical expenses.

Some plans have low monthly payments but high costs for medical services. Others cost more monthly but could save you money if you visit the doctor often.

For example, Ambetter’s Clear Silver plan has a lower maximum out-of-pocket cost ($5,400) compared to its other Silver plans. Although its monthly cost ($432) is higher than average, it offers good medical service options.

Consider Alabama Medicare or Medicaid if You’re Eligible

If you’re 65 or older or have a qualifying illness or disability, you can consider Medicare. It’s a federal health insurance program that provides financial help for healthcare services. Medicare has different parts:

- Part A (Hospital Insurance): Covers hospital stays, skilled nursing facilities, hospice care, lab tests, and surgeries.

- Part B (Medical Insurance): Covers doctor visits, home health care, preventive services, and durable medical equipment for outpatient care.

- Part D (Prescription drug coverage): Pays the prescribed medication cost.

Conclusion

With numerous health insurance options available in Alabama, finding the best and cheapest plan can seem daunting. However, by utilizing our guide and comparing plans by metal tier, income level, and county, you can secure quality coverage at an affordable price.

Don’t wait any longer—take the first step towards protecting your health and financial well-being today!

FAQ About Health Insurance in Alabama

How much is the average health insurance in Alabama?

The cost of health insurance in Alabama is $5,952 for a person Based on the most recent released information.

What is BCBS of Alabama called?

Blue Cross and Blue Shield of Alabama (BCBSAL).

Is BCBS of Alabama a PPO?

Blue Cross and Blue Shield of Alabama will send you an Explanation of Benefits (EOB) once they process your claim. With the BlueCard PPO program, you have the flexibility to select your provider. However, if you opt for a BlueCard PPO provider, you’ll receive improved benefits for numerous services.

Can I get Obamacare in Alabama?

Yes, Alabama residents can apply for Affordable Care Act (ACA) health insurance plans.

Can you have Medicaid and private insurance in Alabama?

Yes, Medicaid eligibility is determined by income and other criteria. You must inform us if you have any other insurance coverage.