In Hawaii, finding the best health insurance plan involves considering various factors such as coverage options, network availability, and affordability. Several insurance companies offer a range of plans tailored to meet the diverse needs of individuals and families across the state.

When choosing a health insurance plan in Hawaii, individuals should prioritize comprehensive coverage for essential health services, including doctor visits, hospital stays, prescription drugs, and preventive care. Plans with low deductibles and copayments can help individuals manage healthcare costs effectively.

This comprehensive guide will help you find the perfect plan to meet your healthcare needs and budget.

How much does health insurance cost in Hawaii?

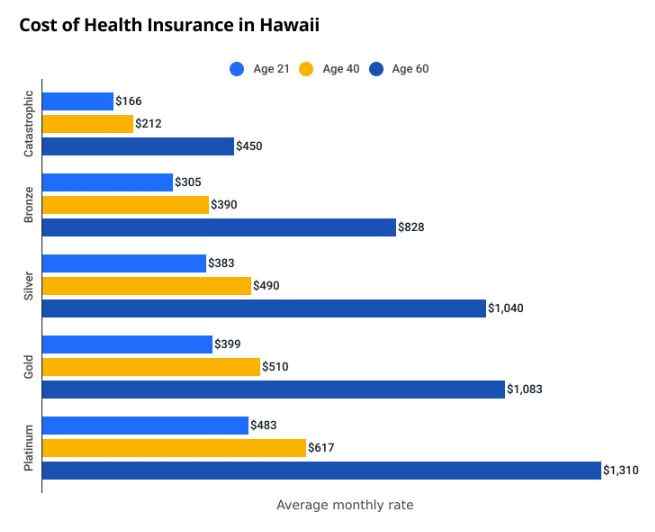

In Hawaii, health insurance typically costs around $490 per month for a 40-year-old with a Silver plan. Higher-tier plans have pricier monthly rates but also lower costs when you visit the doctor or get prescriptions filled.

In Hawaii, your age plays a significant role in determining your health insurance rates. A 60-year-old will pay over double what a 40-year-old pays for the same coverage.

Overall Best Health Insurance in Hawaii

Kaiser Permanente offers the top health insurance in Hawaii. It provides members with affordable plans, low out-of-pocket costs, and fewer claim denials than other options. To reach this conclusion, we examined four Silver plans in Hawaii, including both HMO and PPO types.

Kaiser Permanente

We recommend Kaiser Permanente as the best health insurance option in Hawaii. They offer an average of three Silver plans priced around $471 per month, with a maximum out-of-pocket cost of $8,967.

Kaiser Permanente specializes in Silver HMO plans, where you typically need to select a primary care doctor and obtain referrals to visit specialists. The company’s denial rate is 8.45%, which is better than many other providers.

- Excellent lower out-of-pocket costs

- Approves almost all claims

- Average types of plans available

We recommend the below Silver plans –

- KP HI Standard Silver 5900/40: $457/month

- KP HI Silver 4000 Ded/600 Rx Ded: $470/month

- KP HI Silver 3000 Ded/600 Rx Ded Plus CAM: $485/month

Best Health Insurance in Hawaii for Low Out-of-Pocket Costs

Kaiser Permanente is rated as the top choice for health insurance in Hawaii, especially for low out-of-pocket costs. They provide affordable rates, minimize out-of-pocket expenses, and have a better-than-average track record for approving claims.

We examined a total of six Gold and three Platinum plans, which include both HMO and PPO options, for this assessment.

Kaiser Permanente

Kaiser Permanente is the top choice for affordable health insurance in Hawaii, particularly for keeping out-of-pocket costs low. They offer three Gold and two Platinum plans, averaging $546 per month, with a maximum out-of-pocket cost of $6,500.

These plans are HMOs, meaning you must stick to the plan’s network of doctors for the best prices. Kaiser Permanente also has a denial rate of 8.45%, lower than many other providers.

- Excellent lower out-of-pocket costs

- Approves almost all claims

- Affordable premium rates

- Average types of plans available

We recommend the below Silver plans –

- KP HI Platinum 0/5 Plus CAM: $616/month

- KP HI Standard Platinum 0/10: $609/month

- KP HI Standard Gold 1500/30: $480/month

Best Cheap Health Insurance in Hawaii

Kaiser Permanente is the top choice for affordable health insurance in Hawaii. They offer plans with cheaper rates and lower out-of-pocket costs on average. Additionally, they have a lower denial rate for claims than other providers.

For this review, we examined four Silver plans in Hawaii, including three HMO plans and one PPO plan. We focused more on plans with lower monthly premiums. Remember that plans with lower premiums often come with higher out-of-pocket costs.

Kaiser Permanente

Our top choice for affordable health insurance in Hawaii is Kaiser Permanente. They provide three Silver plans with an average monthly rate of $471 and an average maximum out-of-pocket cost of $8,967.

Kaiser Permanente offers HMO plans, where you need to pick a primary care doctor and get referrals for specialists. Their denial rate is 8.5%, which is lower than many other providers.

- Minimal out-of-pocket cost

- Approves almost all claims

- Affordable premium rates

- Average types of plans available

We recommend the below Silver plans –

- KP HI Standard Silver 5900/40: $457/month

- KP HI Silver 4000 Ded/600 Rx Ded: $470/month

- KP HI Silver 3000 Ded/600 Rx Ded Plus CAM: $485/month

Best Health Insurance for Low Income in Hawaii

Kaiser Permanente offers the best health insurance in Hawaii for those with low income. They have low premium rates and don’t deny many claims, but their maximum out-of-pocket cost is higher than average.

We reviewed three Silver CSR HMO plans and one Silver CSR PPO plan in Hawaii. We focused on plans with low monthly premiums and looked for ones with cost-sharing reductions (CSRs) to help individuals with low income. CSRs can lower your out-of-pocket costs, like deductibles. Typically, a Silver plan covers about 70% of health care costs, but CSR Silver plans can vary.

- If you earn between $31,260 and $39,075 per year (201%–250% of the Federal Poverty Level), about 73% of your health insurance costs are covered.

- If you make between $23,445 and $31,260 per year (151%–200% of the FPL), approximately 87% of your healthcare costs are covered.

- If your income is below $23,445 per year (up to 150% of the FPL), then around 94% of your health care costs can be covered.

These income thresholds may change depending on the size of your household.

Kaiser Permanente

Kaiser Permanente is the top choice for affordable health insurance in Hawaii for people with low income. They provide budget-friendly plans for individuals earning less than 250% of the Federal Poverty Level. Kaiser Permanente offers three Silver CSR plans for eligible individuals, with an average monthly cost of $471. The average maximum out-of-pocket expense for these plans is $7,233.

Kaiser Permanente doesn’t provide PPO or POS plans in Hawaii. Instead, they focus on HMO plans, which typically have cheaper monthly payments. Their denial rate is 8.45%, indicating they’re more likely to approve claims compared to other companies..

- Minimal out-of-pocket cost

- Approves almost all claims

- Affordable premium rates

- Average types of plans available

Here are examples of lower total out-of-pocket expenses based on different income levels –

- 201%–250% of FPL: $457/month

- 151%–200% of FPL: $457/month

- Up to 150% of FPL: $457/month

Best Health Insurance for Young Adults in Hawaii

Blue Cross Blue Shield offers the top health insurance for young adults in Hawaii. They provide affordable plans with lower out-of-pocket expenses and process claims similarly to other companies.

For this, we reviewed one Bronze HMO plan, two Expanded Bronze HMO plans, two Expanded Bronze PPO plans, and one Catastrophic PPO plan. Remember, Catastrophic coverage is only available for individuals under 30 years old.

Blue Cross Blue Shield

Blue Cross Blue Shield is our top choice for young adults’ best health insurance in Hawaii. Young people often pick plans with less coverage as they typically need less medical care. Blue Cross Blue Shield offers one Catastrophic and two Expanded Bronze plans. These plans average $251 per month with a yearly maximum out-of-pocket cost of $8,650.

Blue Cross Blue Shield provides PPO plans, allowing you to visit more doctors outside the network. Its denial rate is average, around 17%.

- Lower premiums.

- Low out-of-pocket costs.

- Diverse plan options.

We recommend the below plans for young adults –

- HMSA Bronze PPO II HSA

- $306/month for 18 year olds

- $343/month for 26 year olds

- HMSA Catastrophic Plan

- $151/month for 18 year olds

- $170/month for 26 year olds

- HMSA Bronze PPO I

- $296/month for 18 year olds

- $332/month for 26 year olds

Best Health Insurance by Plan Type in Hawaii

Health insurance companies offer various types of plans. In Hawaii, one Silver PPO and three Silver HMO plans are available. The top providers for each plan type in Hawaii are:

- PPO: Blue Cross Blue Shield

- HMO: Kaiser Permanente

Our recommendations focused on Silver plans. These plans are popular because they balance monthly costs with what a person pays for medical services. Silver plans are helpful for people who visit the doctor or need healthcare frequently.

PPO: Blue Cross Blue Shield

Blue Cross Blue Shield is our top choice for the best health insurance in Hawaii for Silver PPO plans. They provide plans with an average monthly rate of $551 and an average maximum out-of-pocket cost of $9,100. The company typically denies claims at an average rate of about 17%.

PPO plans allow you to pick your doctors and visit specialists without needing referrals. But they often come with higher costs compared to other plans, so they might not be the best option if you’re looking to cut expenses.

We recommend the below Silver PPO plan from Blue Cross Blue Shield –

- HMSA Silver PPO: $551/month

HMO: Kaiser Permanente

Kaiser Permanente is our top choice for the best health insurance in Hawaii among Silver HMO plans. They provide plans with an average monthly rate of $471 and an average maximum out-of-pocket cost of $8,967. Kaiser Permanente also has a denial rate of 8.45%, meaning it rejects fewer claims than other providers.

Silver HMO plans often have lower monthly costs and are popular. Remember that you must stick to doctors within the network and get a referral to see a specialist. HMO plans are great for saving money if you’re okay with seeing doctors in the network.

We recommend the below Silver HMO plans from Kaiser Permanente –

- KP HI Silver 4000 Ded/600 Rx Ded: $470/month

- KP HI Silver 3000 Ded/600 Rx Ded Plus CAM: $485/month

How to Find the Best Health Insurance for You in Hawaii

The best health insurance for you depends on your needs and finances. If you often need medical care, you’ll need more coverage. Pick a plan that matches what you need and what you can afford:

Understand when a health insurance plan will cover you

Health insurance plans have a list of doctors or hospitals called “in-network providers.” You can visit these places for care; your plan will cover part of the cost. If you go to a doctor or hospital not on the list, known as an “out-of-network provider,” your plan might not cover the cost or may cover less.

In Hawaii, there is one PPO plan and three HMO plans available. PPO plans allow you to choose out-of-network doctors but might be more expensive. HMO plans may cost less, but you must stay within the network.

Weigh the cost of premiums vs. the cost of care

When searching for health insurance, you should consider two main costs: the monthly premium and the maximum you’ll pay in a year if you need a lot of medical care. Some plans have lower monthly premiums but higher costs if you use many medical services. Other plans might cost more each month but have lower prices if you need medical care.

For example, let’s consider the Silver plan from Kaiser Permanente. The KP HI Silver 4000 Ded/600 Rx Ded plan has a maximum out-of-pocket cost (MOOP) of $8,900 and a monthly premium of about $470. This is slightly lower than the average cost of Kaiser Permanente’s Silver plans, which is $471 monthly. If the plan has good doctors and hospitals near you, choosing the KP HI Silver 4000 Ded/600 Rx Ded plan could be intelligent.

Consider Hawaii Medicare or Medicaid if You’re Eligible

In Hawaii, people aged 65 and older or those with certain diseases or disabilities might qualify for Medicare. Medicare is health insurance from the federal government, often with lower costs than private plans.

Unlike Medicaid, Medicare usually requires a premium. However, it offers more choices for healthcare, letting individuals pick a plan that suits their needs and budget. Medicare has three parts:

- Part A (Hospital Insurance): Covers in-hospital expenses, such as inpatient hospital care, home health care or hospice care.

- Part B (Medical Insurance): includes medical supplies, preventative services, doctors’ services, and other medical-related expenses.

- Part D (Prescription drug coverage): covers prescription drugs and vaccines.

In Hawaii, Medicaid is expanded, allowing people to qualify based solely on their income. Residents in Hawaii who earn less than 138% of the Federal Poverty Level may be eligible for Medicaid. For instance, a family of four can qualify if their monthly income is below $3,208.

FAQ: Hawaii Health Insurance

What is the average cost of health insurance in Hawaii?

The average health insurance cost in Hawaii is $6,000 per person, according to the latest data. So, for a family of four, it would be $24,000.

What is the most common insurance in Hawaii?

HMOs and PPOs are Hawaii’s most popular types of health insurance plans.

Does Hawaii have free health insurance?

The Hawaii Medicaid Fee-For-Service Program offers free or low-cost health coverage to individuals aged 65 and older or those with specific disabilities.

Is medical care free in Hawaii?

Hawaii’s Medicaid program, Med-QUEST, offers free or low-cost health coverage to low-income people and families.

How many people in Hawaii have Medicare?

In 2023, there were approximately 298,533 Medicare enrollees in Hawaii.